“On one side it’s a gift from heaven for the European PET producers, but on the other side it may be a curse,” a source said.

Indeed, sellers are already individually seeking higher PET prices for January.

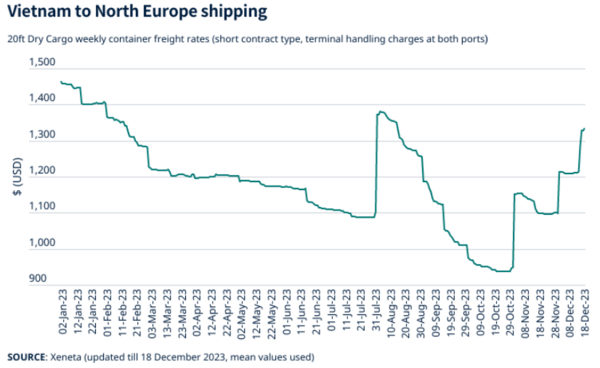

“I’m getting frightening information: most import offers are on hold. European [suppliers] plan on increasing the price dramatically, because of the Suez Canal situation and delays,” a buyer said.

Of course nobody knows how intense the problem really is and how long it will last.

The timing of a fresh shipping crisis is terrible, what with market participants ready to step away from their offices for the holidays.

“We are not offering and will open the shop again next year when we know about availability and costs,” a producer said.