One of the main challenges for Russia today is to decrease the volume of dumping of unsorted waste. This would mean that the waste would be reused, i.e. given its second life, so it would give a big push for recycling industry development as well as the related businesses.

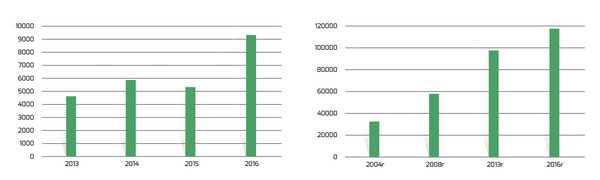

Fig. 1: PET granules production per years, MT Fig. 2: Volume of collection in tons

There are very few recycling companies in Russia - representatives of the “green economy” can be counted on one hand. The Plarus plant of Europlast Group is one of such companies, being the only company, which recycles PET into food grade granulate under “bottle-to-bottle” technology.

The construction of the plant in Solnechnogorsk (Moscow Region) started in 2007 with equipment for the production facility from Sorema (Italy), Bühler AG (Switzerland), RTT GmbH (Germany), Titech GmbH (Germany), BOA (Holland) etc.

In 2009, the first products were manufactured and the plant forges ahead, constantly developing and changing. The matter is that Russian raw materials differ from European ones; therefore, the equipment should be adapted to the new conditions. And since quality is the main criterion of demand for recycled PET granulate, Plarus is particularly mindful of the quality of products, which complies with the best similar European products.

The washing line and mill were completely replaced, and additional metal separator was installed in 2011. The modernization of the production facilities resulted in increase of the plant capacity and significant improvement of product quality. In summer 2016, modernization of the conveyor line in the raw material sorting production department was completed in order to ensure better capacity and higher processing volume.

The plant’s processing capacity amounts to 30,000 tons of waste plastic PET containers (mostly, plastic bottles used for drinking liquids). In 2015, the processing volume amounted to about 18,000 tons of PET waste; 9 months of 2016 evidence positive growing trend of the volume of raw materials, which holds out a hope for the plant’s work load close to the estimated capacity following the results of 2016, as it is reflected in the diagram.

Product quality is the strength of Plarus and Plarus process engineers, together with product users and potential customers, are engaged in perfection of the product - they test granulate, carry out R&D researches, perform audits at the facility. Anyway, the company is adjusted to the requirements of major international bottlers, the most discerning and strict customers, and there is a vivid tendency of interest towards recycled PET which results in increase of the number of customers from 8 in 2000 to 15 in 2016 and 30 customers are estimated in 2017. The average growth rate of the collected bottle volume is around 12% (fig. 2).

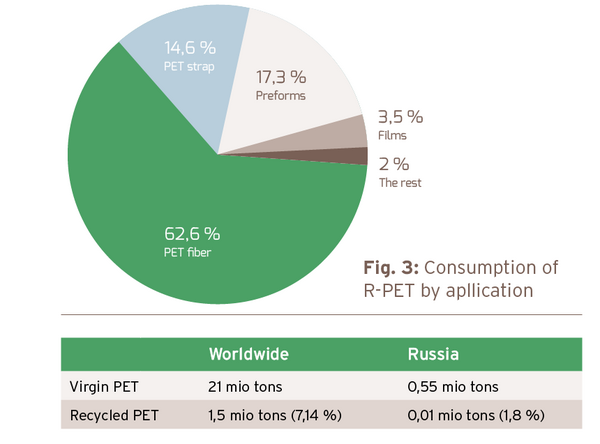

The drive of the food industry to mitigate the adverse impact on the Russian environment is picking up quickly. Nowadays, the companies take more careful approach to selection of packaging - it becomes lighter, materials get better, heat shrink film area is reduced, recyclable raw materials are preferred in most cases. PET containers and packaging with addition of R-PET become more and more popular in the market. However, just 17% goes for bottl grade consumption (fig. 3, table 1).

The trend is evident. Europlast Holding Company, represented by plants, which produce virgin (Senezh) and recycled granulate (Plarus), as well as by other 7 plants, which produce PET preforms (Europlast), is ready to satisfy growing demand of the market. Even today, almost all plants of Europlast group are equipped with dosers, which allow to produce preforms, 10-50% of which are made of recycled raw material.

Table 1: Consumption of PET in 2015

Recycled raw material is promoted by the state

What is more important, use of containers and packaging made of recycled raw materials is promoted by the state. For instance, the laws include a regulation, which allows to reduce the amount of environmental fee (disposal ratio) in inverse proportion to the share of recyclable raw materials in the total volume of the raw materials used for production of packing. That is, if to take 2016 where the companies-consumers of PET have to collect 5% of their total consumption volume or pay the eco fee, alternatively they could consume 5% of R-PET and in this case the obligation to pay the environmental fee or to comply with the disposal ratio will be deemed fulfilled when yearly reports are submitted to the supervision bodies.

Revolution in the waste treatment industry

Europe has made its evolutional way of establishment of the waste recycling industry and recycling development. Russia goes after the revolutionary path of development. Quite recently, in December 2014, 3 years of discussion in the Parliament resulted in adoption of Federal Law no. 458-FZ, which establishes principally new approaches to waste management / 1/.

Adoption of this Federal Law has initiated a revolution in the industry. The Law establishes some fundamental innovations, such as:

Extended liability of product manufacturers and importers for disposal of packaging and goods after loss of consumer appeal - the companies have obtained an opportunity to develop waste collection and disposal system in accordance with actual Disposal Ratios on their own (as well as by way of creation of the association (union) of manufacturers, goods importers) or to pay an alternative Environmental Fee to the state.

If the packing of the goods to be utilized is made of secondary raw materials, the decreasing factor is applied to the Disposal Ratio to be calculated as the difference between one and the percentage of recycled raw materials used in production of such packaging.

Collection of data and creation of the information system concerning sources of waste generation, places and volumes of generation, morphological and fractional composition of waste in all regions of the Russian Federation;

Adoption of similar Territorial Waste Management Schemes (graphic (schemes, drawings, layouts and other materials) and textual descriptions of the system of organization and performance of waste management activities within the territory of the region of the Russian Federation and its growth directions for a certain period) at the regional level;

Establishment of the Regional Operator institute at the regional level; waste removal monopolist company would be selected for a 10-year term. This may be one company or several companies, depending on the area of the territory and waste generating volumes. This company would be responsible for the entire waste management chain within its territory. It will also accept payments from people and organizations, enter into contracts with waste management contractors.

Among other things, subject to provisions of the law, the Regional Operator will also carry out liquidation of illegal dumps, improve container yards, implement separate waste collection system etc.

Talking of separate waste collection

Most people in countries with a well-developed recycling systems are aware that waste should be separated or sorted so that it could be recycled. In Russia, apparently, the industry will develop in the second direction. There are a lot of examples of effective work of waste separation system in the country, but in absence of financial incentives for people and governmental support measures they are economically unprofitable.

The Russian laws have not defined separate collection yet, and the Sanitary Regulations of Residential Areas Maintenance adopted in 1988 stipulate that waste should be kept on a collection site (container yard) for no more than three days during the cold season, and for no more that one day during the warm season (daily removal). But daily removal of half empty plastic containers increases operating costs of the company, decreasing profitability and, finally, increases the cost of recyclable raw materials.

However, according to regulations of the law, starting from 2023, dumping of unsorted waste would be prohibited. But until then, there will be regulations that prescribe the systematic increase in the percentage of sorted waste.

In order to support development of enterprises engaged in waste sorting, the Government of the Russian Federation intends to establish relevant waste sorting fee. Probably, this solution is forced, since many good initiatives are not implemented in Russia because they are not backed by money. Now, with such fee, business will have more opportunities to substantiate investment attractiveness and to obtain credit financing in banks for implementation of new projects. Finally, potential development of the companies involved in disposal (recycling) of raw materials is subject to the volume of recyclable raw materials. However, waste sorting also seems attractive at this stage, since all generated useful fractions are sold in the market.

Unlike other stages of waste management, which have the appropriate fee paid by residents of the region in the form of bills for waste removal, waste recycling into the secondary material resources is not supported by fees, is not subsidized and not funded by government.

However, the state program is being developed to support establishment of new processing enterprises. But as to those few companies, which have already been established, they have the mechanism stipulated by the Law for exercise of extended responsibility of manufacturer/importer for goods and packing disposal upon the loss of consumer appeal.

It can be assumed that this will be the most promising for processing companies due to formation of the system of compensation of a part of the recycling costs through execution of civil law contracts for provision of relevant services. However, its prospects will depend primarily on the size of the Environmental Fee.

The state has deliberately decided to delay the process in order to avoid “shock therapy” by establishing lower rates of the Environmental Fee. Manufacturers understand this as well. Thus, for example, in late November 2016 Coca-Cola Russia launched “Separate with Us” federal program. According to the data from the company, by the end of 2016 Coca-Cola intends to collect and to deliver for recycling more than 4,500 tons of plastic waste, and by 2020 to recycle at least 40% of waste consumer packing. Well, it’s a good start. And it would be nice to have many similar projects of consistent nature aimed both at collection and at recycling of waste.

Plarus is in contact with many manufactures to support them with information and service, either to arrange separate waste collection or to sell RePET granules as an option of fulfilling their disposal ratio.

Problems with Raw Materials

Plarus plant still receives raw materials from suppliers from various Russian regions. Piles of PET bottles weighing 250-300 kg each are transported by trucks from Central Russia, Krasnodar Krai and even Siberia. Supplies of raw materials are not always stable, prices vary, which required formation of 2-week stock to prevent downtime of the plant.

All raw materials, which passed through strict acceptance control at the enterprise, are accepted for production. And, in spite of this, the ratio of finished products is about 50%, while the average European ratio equals to 75-80%. This is due to the fact that, in absence of separate collection system, raw materials are picked at the sorting stations or manually when entering landfills. Not surprisingly, the quality leaves much to be desired. It is one thing to separate waste for multiple containers or 2 containers - organic/non-organic. It’s a different story when mixed waste is first removed by dump trucks, which compress and squeeze it, whereupon this waste can be transshipped several times until it is eventually transported to a landfill for burial.

As a result: sand and dirt, organic fractions and press make even plastic PET bottle mat with a layer of grey thin coat and often not recognizable by even the most up-to-date optical sorting systems by colors installed at Plarus. This causes one of the main problems of recyclers - high costs of preparation of raw materials for recycling. Such costs include labor costs (at the stage of additional manual sorting of raw materials), increased consumption of detergents (for removal of sticky dirt and labels), electricity, water, etc.

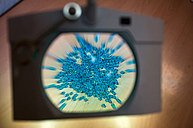

Apart from raw materials sorting production department, there are also 2 other departments at the facility - washing and mincing, which generate an intermediate product - PET flakes and extrusion and polycondensation unit. The final stage of production results in generation of PET granulate, the quality and physical/chemical properties of which conform with the quality of primary PET granulate. This is recycling PET produced by Plarus.

By the way, smaller filters are installed at the extrusion stage, and PETF melt passes through the filter with 40 micrometer grid, which, though, results in decrease of product yield, but significantly enhances its quality.

Meanwhile, production output allows to maintain demand by such companies as Coca-Cola and Freudenberg, well-known representatives of socially responsible business, committed to mitigation of the adverse impact of production and consumption on the environment. Currently, two more companies - Danone and Pepsi - are willing to procure recycling PET being at the stage of product approval process.

The company’s initiatives for separate waste collection

Plarus plant competes for clean raw materials, actively promoting the idea of separate collection of waste to the public and holding events at schools and among volunteering participants of PET waste collection programs, jointly with the Moscow Department of Natural Resources Management (Mospriroda). Plarus exposition is scheduled to be exhibited in Moscow River Museum and Forest Museum in 2017 - “Year of Environment in Russia” - in order to promote plastic recycling.

Among other things, the company implements its own PET collection project “Give the Bottle a Second Life” and the “Recycle Plastic” project, jointly with Coca-Cola and Solnechnogorsk District Administration. Since 2010, PET waste has been collected into wire mesh containers located throughout the city area in Solnechnogorsk, Moscow Region, for further recycling at Plarus plant.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.