Globally, PET bottles enjoy a comfortable position in retail beverage packaging. PET is also among the most dynamic growth pack types looking at data to 2021, widening the gap with key competing pack types such as metal beverage cans, glass bottles and liquid cartons. Despite this bright outlook, PET bottles will need to address key trends shaping soft drinks packaging globally. Key considerations include healthier positioning, portability for consumption on-the-go, and greater sustainability credentials.

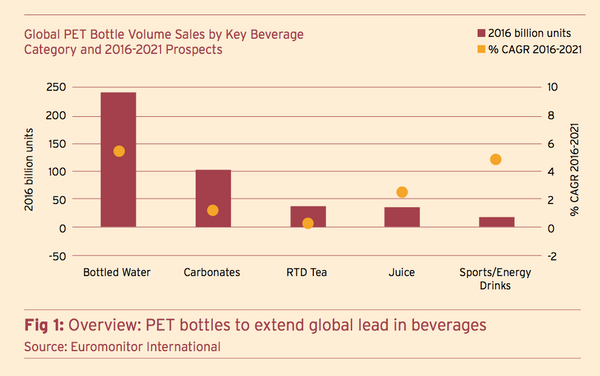

PET bottles is the pack type with the largest sales volume in beverages globally, with 454 billion units sold in 2016 and a leading position in most soft drinks categories. PET remains largely unchallenged in bottled water. Its closest competitor, the thin wall plastic container, is largely confined to a share of the bottled water packaging market in Indonesia, where it has traditionally been sold as an impulse pack format through small street stores. Glass bottles are more widely found across the world but are restricted to the premium end of the spectrum. The growth potential for other alternatives to PET, such as metal beverage cans and shaped liquid cartons, remains marginal in comparison.

Pack type competition is much more tangible in carbonates, the next biggest application globally for PET bottles. Metal beverage cans have a similarly large volume share of the category globally; however the leading PET bottle format is set to erode this share, as beverage cans struggles in its key North American market. Juice is also a complex category for PET to expand in given the pack type competes closely with liquid cartons but also aluminium/plastic pouches, metal beverage cans and glass bottles. And yet the 2016-2021 forecast period looks quite positive here again.

Metal beverage cans and brick liquid cartons are challenging PET’s lead for RTD tea in Asian countries, where the bulk of RTD consumption is concentrated. The beverage can is generally perceived as more modern than the established PET bottle and increasingly appeals to Chinese, Indian and Indonesian millennials.

PET BOTTLE FOR HEALTH POSITIONING: FROM WATER SAFETY TO AN EYE-CATCHING, PREMIUM SOLUTION

Much of PET’s future growth in beverages is expected to come from Asia-Pacific, where rising income levels and hygiene concerns over tap water are causing consumers to switch to bottled alternatives. This is the case in India, for example, where the non-availability of clean drinking water in some areas is pushing people to increasingly turn towards bottled water. This is being supported by retail expansion and growing product availability.

North America will, however, contribute the second biggest unit volume increase for PET to 2021. Significant anti-sugar policies and rising health concerns over calorie intake are encouraging US consumers to switch from sugary drinks such as carbonates and juice drinks towards bottled water.

Carbonates are particularly exposed to anti-sugar policies. A tax on sugary drinks is already in place in some countries such as Mexico and France, and being considered in others such as the UK and South Africa. Against rising concerns over obesity and other health problems relating to sugar intake, consumers, especially in the US, are reducing consumption of carbonates; being also suspicious of sugar alternatives such as sweeteners.

Carbonate brand owners have responded to these health concerns with a craft offering. Glass is set to benefit from this trend and to outperform metal beverage cans over 2016- 2021. Glass bottles tend to convey a higher end positioning and accentuate and image of healthy, natural ingredients. In Western Europe, the brand Fever Tree in glass bottles has made good progress, albeit from a very low unit volume base. Through innovation, PET bottles can also tap into the rise in more natural carbonated drinks and perhaps widen their consumer reach through a value for money offering.

RAISING PET BOTTLE FUNCTIONALITY: GOOD OPPORTUNITIES FOR CONSUMPTION ON THE MOVE

As well as a healthier value proposition, consumers will also increasingly seek portable pack solutions. Pack sizing strategy will be an essential aspect of a successful product to 2021, and the flexibility offered by PET represents a major selling point in soft drinks. Small, single-serve bottles of 500ml and below are to increase in popularity in mature regions such as Western Europe. In 2016, the Evian brand chose a 370ml shaped PET bottle for its new range of flavoured water Fruits & Plantes; a format that can be carried along in a handbag. Single-serve formats are equally important in juice with the rise of coconut and other plant waters.

Small pack sizes are also particularly key in targeting consumption amongst children. For example both Poland and Turkey saw the launch of a still water product range in easy to carry, 330ml PET bottles and shrink wrap sleeves designed to look like cartoon characters.

PET bottles will also remain key in delivering soft drinks for household consumption, whether it’s complex logistics favouring home delivery of 15 to 20-litre water cooler type bottles, as in rural Russia, or where large households seek 2 to 3.3-litre bottles of carbonates, as is the case in Mexico, or where the ease of use of multi-packed, 1.5 litre varieties are sought after, as in Spain. Further pack functionality can go a long way, for example in winning favours among older consumers. In 2016, the Volvic brand was made available in France in a 1-litre PET bottle with a new plastic screw closure that offers a better grip and aims to be easier to open.

ADDRESSING GROWING PRESSURES FOR MORE SUSTAINABLE PACKAGING

Last but not least, concerns over littering and resource depletion will spur greater demand for more environmentally- friendly pack solutions. One of the costs of PET bottles’ volume significance worldwide in soft drinks is that PET manufacturers and brand owners will be expected to provide more viable solutions for environmental sustainability.

Leading carbonate brand owners such as Coca-Cola and PepsiCo are clearly increasing efforts to encourage consumers to recycle more. In 2016, PepsiCo launched a tv ad in the US to that end. In the summer of 2017, Coca-Cola launched its first campaign in the UK for the recycling of plastic packaging. This is in line with Coca-Cola’s pledge at the beginning of the year, to increase PET recycling rates from 14% to 70% to 2025.

PET lightweighting is, to a considerable extent, nearing its limits. But lightweighting initiatives still have potential to both reduce a product’s environmental footprint and operational costs in some areas such as developing Asian countries like Vietnam or Malaysia. Notwithstanding the environmental advances achieved through lightweighting initiatives in more developed countries, increasing recycling rates for PET alongside use of returnable bottles could further help re- inject value into the PET industry and recovery systems.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.