Hygiene concerns about tap water are still a reality across many developing countries – and remain one of the biggest drivers for PET bottle growth globally today. Over half of PET’s sales volume increase over 2015-2019 is due to come from the still bottled water category. Even more significantly, the overwhelming majority of this additional PET volume in still water will be generated in developing countries. As dynamic economic growth encourages a rise in income levels and goes hand in hand with retail developments in a number of these countries, more and more people will be switching from tap to packaged water.

PET bottled water on a steady increase in Asia amid rising hygiene levels

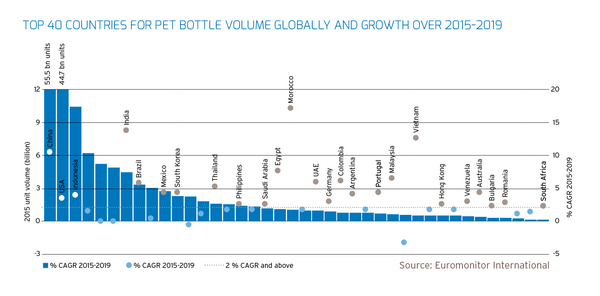

In 2015, global volume sales of PET bottles amounted to 469 billion units across the retail landscape. A third of this volume was accounted for by still bottled water. Looking ahead, still bottled water is likely to represent some 54% of overall additional volumes sold between 2015 and 2019.

In PET’s global future growth as a packaging format for water, the role of Asia Pacific is simply paramount. Demand coming from China in 2015 was a long way ahead of any other country. In 2015, Nongfu Spring Co Ltd: Mother and Infant Water in a premium-looking 1-litre PET bottle was launched, which aims to address concerns from mothers with young children over tap water. Asia Pacific is also home to multiple countries with forecast growth above a CAGR of 2% to 2019, including Indonesia, India, the Philippines and Malaysia. A common denominator in these countries is the high levels of concern among the population over the risk of catching a waterborne disease if drinking unpackaged water. An increasing number of Indians and Filipinos shy away from drinking water from the ground, tap or water purifier as they fear they might contract either diarrhoea, typhoid fever or cholera. In the Philippines, one key alternative to water in PET bottles remains water that is purchased in bulk from refilling stations. Malaysians, by contrast, tend to boil water at home in order to sanitise it. However, in 2015, dry spells and the smoke from climate-related forest fires coming from Indonesia both resulted in a lack of water supply in some parts of the country. A water-rationing programme led by the Malaysian government resulted in many consumers switching to water packaged in PET.

Water supply and fears over contamination in other developing regions

Latin America is also of significance to the forecast global PET volume increase in still water. Brazil, the number one market in the region in 2015, is anticipated, along with most other Latin American countries, to see PET grow by a CAGR of more than 2% to 2019. In 2015, drought in Brazil as well as an ineffective infrastructure for delivering drinking water caused a serious lack of supply. Major cities such as Sao Paulo implemented a water-rationing system, which, here again, caused a surge in bottled water sales.

Africa and the Middle East boasts dynamic growth prospects to 2019. Egypt has one of the highest kidney failure rates in the world, which has been strongly linked with the lack of a reliable source of clean drinkable water. Most Egyptians believe tap water is contaminated and may cause health problems, such as kidney stones, so that the PET bottle is the primary option for drinking water. Meanwhile, South African consumers also continue to turn to bottled water owing to new reports of pollution in water reservoirs throughout the country.

Health concerns over drinking water also a reality in Europe and North America

On the European continent, Turkey and Russia have to be added to the list. Across most of Russia, the quality of tap water remains poor and tap water is known for containing dangerous amounts of lead. Russians households are expected to continue to switch to packaged water for drinking and cooking. Given the logistical challenges in the retailing of bottled water posed by the long distances involved in Russia, home delivery of water cooler bottles in large sizes such as 12.9 litres and 18.9 litres, is one promising route for PET in the country.

Even in the US, public supply of tap water can sometimes fail to reassure its users. This was illustrated by the switch to a less reliable lake as a main source for drinking water in Flint, Michigan, earlier in 2016. But, beyond reassuring customers, brand owners should ensure their strategy is long term and that they have both strict quality controls in place as well as communication as transparent as their bottle when it comes to their own bottled water supply. Following in the footsteps of Coca-Cola back in 2013, PepsiCo gave in to rising pressure from corporate responsibility activists to clearly state on its Aquafina bottles that its water comes from the tap /1/. The company decided in late 2015 to change to having “public water source” spelled out on its labels. As consumer awareness grows about practices followed by bottled water producers, failure to focus on quality and clear communication can negatively impact on brand perception.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.