The Indian plastic packaging industry has shown very stable growth rates over the past decade. Plastic packaging has penetrated almost all areas of the packaging industry in the country during these years. In addition to convenience, plastic packaging has also brought with it a lot of plastic waste. This article provides an overview of plastics recycling in India as well as a focus on the country’s energy needs and future prospects, and how future energy needs will impact the PET and plastic packaging industries.

Overview of the plastic packaging industry in India

According to a recent study by the Indian Trade Association, the Associated Chambers of Commerce and Industry of India (ASSOCHAM) and global consulting firm Ernst & Young, the total packaging industry in India is expected to reach $ 72.6 billion by the end of fiscal 2020 (31 March 2020). /1/

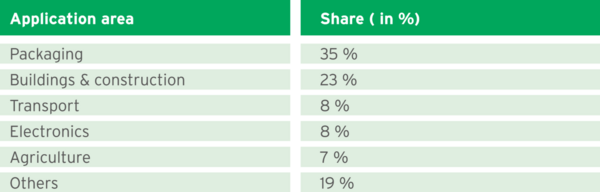

Table 1: Plastic consumption by application in India /1/ (Source: Federation of Indian Chamber of Commerce and Industry ( FICCI) )

India’s economic growth in recent years is expected to maintain its strong momentum in the coming years. India’s Gross Domestic Product (GDP) is projected to reach $ 6 trillion by Financial Year 2027 (April 2026 - March 2027) and to reach upper middle-income status through digitization, globalization, favorable demographics and reforms. /2/

The new prosperity will be a catalyst for the growth of plastic packaging in the country. Favorable demographic patterns in India, such as rising population, growing working-age population, growing disposable income, middle-class growth, progressive urbanization and changing lifestyles, will further boost the growth of the plastic packaging industry in India.

Table 2: Current and estimated packaging consumption breakdown by volume in India by material type /3/ (Source: Credit Rating Information Services India Limited (CRISIL) )

Packaging plastic recycling in India

India has taken plastic packaging recycling quite seriously in recent years. There is a very serious focus on the Swach Bharat (Clean India) movement by the government, which indirectly leads to plastic recycling. However, recycling in the country is determined not only by the recent regulations, but also by a small but growing number of organized recycling units and the vast unorganized segment of rag-pickers in the country.

Different authorities, however, give different figures for the recycling of plastic packaging in the country. In the absence of data from a central authority, it is difficult to determine an exact figure for the recycling of plastic packaging.

A recent study by the National Chemical Laboratory (NCL) and the PET Packaging Association for Clean Environment (PACE), a New Delhi-based industrial organization representing PET manufacturers, processors and recyclers, estimated the PET recycling rate in India 90%. According to the study, 65% of PET containers are recycled at registered facilities, 15% are recycled in unorganized segments and 10% in private households, with the remainder landed in landfills. The one-year study was conducted by scientists from the Council for Scientific and Industrial Research (CSIR) and the National Chemical Laboratory (NCL). /4/

“We used a combination of site visits, interviews and written surveys for this

status study, and the team visited (and continues to visit) PET recycling facilities across the country. We identified large-scale industries that produced a variety of products from used PET bottles”, said Dr. Magnesh Nandgopal, the scientist from NCL’s polymer science and engineering division who carried out the study.

He continues, “Not many people are aware that the entire Indian cricket team’s clothing was made from recycled PET bottles for the World Cup 2015. Even the current jersey is made from this material, PET bottles are collected, sorted, cleaned, shredded and processed into “washed flakes.” These washed flakes are used to produce polyester fibers, which serve as padding fillers for example, or are further processed into fabrics for clothing and upholstery.”

Table 3: Plastic packaging industry in India over the years (Source: FICCI)

According to the annual report of the Central Pollution Control Board (CPCB) for the period 2017-18, about 9.4 million tonnes of plastic waste accumulates annually in India (equivalent to 26,000 tonnes of waste per day). Of this, approximately 5.6 million tonnes of plastic waste are recycled per year (ie 15,600 tonnes of waste per day). This implicates that 3.8 million tonnes of plastic waste per year are not collected or thrown away (9,400 tonnes of waste per day). /5/ /6/

Jayesh Rambhia: ''India recycles a high percentage of packaging plastics. We should be thankful to the unorganized scrap merchants sector for the high recycling rate of packaging plastics. Nearly 90 percent of PET bottles are recycled in the country.''

The study by ASSOCHAM and Ernst & Young, mentioned earlier, states that India produces about 0.025 million tonnes of plastic waste every day. Of these, 94% are thermoplastics, including PET, LPDE, HDPE and PVC, all of which are recyclable. Thermosetting plastics, consisting of filmformed composite (SMC), fiber-reinforced plastic (FRP), multilayer plastic and thermoplastic, account for 6% of total waste and are non-recyclable. /1/

Jayesh Rambhia, an official of the Association of the Plastics Industry, All India Plastics Manufacturers Association, says: “India recycles a high percentage of packaging plastics. We should be thankful to the unorganized scrap merchants sector for the high recycling rate of packaging plastics. Nearly 90 percent of PET bottles are recycled in the country. For the entire plastic packaging segment, the share is close to 60 percent. The recycling of all plastic packaging materials, however, presents great challenges. For example, because of low cash returns, multilayer film packages and disposable plastic bags are not collected by rag collectors.”

As an example from the industry, Uflex Limited, one of India’s largest flexible packaging companies, has developed a simple and cost-effective way to convert used plastics into pellets that can be used to make everyday products.

At Indiaplast 2019, held in Greater Noida during 28th Feb- 4th March 2019, Ashok Chaturvedi, Chairman of Uflex Limited, said: “We are ready to take the lead in setting up plastic waste collection centers and recycle multi-layer plastic packaging that is printed, laminated and metallized. The recycling facility for processing two tons of multi-layer plastic packaging waste per day costs around INR 50 million (US $ 0.72 million). Uflex is ready to make the technology available to other companies for free. Machines can be put into operation by manufacturers all over the world.”

According to him, the recycled plastic granules from the MLP waste can be used for injection molding applications such as flowerpots, wastebaskets tumblers, core plugs, road dividers, pallets, lowcost furniture, park benches and other everyday commodities.

Uflex Corporation is the fifth largest BOPET film supplier in the world and India’s leading manufacturer of flexible packaging with an organized market share of almost 25%.

Plastic Waste Management (PWM) Rules

In order to increase plastics recycling in the country, the Indian government issued the Plastic Waste Management (PWM) Rules in 2016. A central element was the “Extended Producer Responsibility” or EPR. The idea of EPR is to let the polluter pay. Therefore, all plastic packaging sellers had to install a waste collection system within six months. But only three years later, after much confusion about how EPR works, plastic packaging manufacturers have finally begun to take small steps.

“Only about 45 companies submitted their EPR plans to the Central Pollution Control Board (CPCB), while the total number of these companies is several thousand,” says S.K. Nigam, Nodal Officer for PWM at CPCB.

However, over the past year, the CPCB has begun to set EPR waste recovery targets. CPCB has begun to list Producer Responsibility Organizations (PROs) to which manufacturers can outsource their obligations. These efforts are expected to intensify efforts to recycle plastic packaging in the country.

Urgent need to step up plastic packaging recycling efforts

Due to the enormous use of plastic packaging, India offers enormous potential for the recycling of plastic packaging products. However, the country needs a structured political and regulatory framework that paves the way for organized recycling companies.

While India has become aware of the need to recycle plastic packaging in recent years, there is an urgent need for quantitative investment in modernizing the sector and adapting to the latest technologies and practices in this area.

The plastic pollution debate in India has been worsening day by day. In June 2018, the federal Government announced that by 2022, the country would “ban all disposable plastics from the countryside.” /7/

Promoting the recycling industry will not only benefit the environment, but also help save resources and create jobs. As mentioned earlier, the consumption of plastic packaging in India is expected to show steady growth rates in the coming years. In these circumstances, the recycling of packaging plastics is a viable and sustainable option for the growing material needs of the country. For India, it is important to move from a ‘produce, consume, dispose’ approach to a ‘reduce, recapture, reuse, recycle, redesign, recycle’ approach.

Removing barriers to input factors, establishing a marketplace for scrap and recycled products, promoting public procurement and raising consumer awareness are some of the steps that could act as a catalyst for strengthening and developing the recycling of plastic packaging in the country.

Energy demand in India

India’s energy sector is facing a sea change, given the Indian Government’s recent development ambitions: 175 GW installed capacity of renewable energy by 2022, 24X7 electricity for all by 2022, housing for all by 2022, 100 Smart Cities missions, 10% reduction in dependence on oil and gas imports by 2022, compared to 2014-15, and provision of clean cooking fuels. India should play a key role in the global energy scenario in the coming years.

With 18% of the world’s population, India consumes only 6% of the world’s primary energy. This is reflected in India’s low per capita energy consumption (600 kgoe in 2014), which accounts for one third of the world average. /8/

Correlation between energy demand and industrial growth

Energy is one of the most important building blocks of human development and, as such, a key factor in the economic development of all countries.

India’s growing economy and booming population expect a rapid increase in energy demand over the coming decades. This would be welcome news for the production and consumption of plastic packaging in the country. The production and consumption of PET in the country is expected to benefit immensely, as it is one of the fastest growing areas of the plastic packaging industry.

Future projections

According to the International Energy Agency (IEA), India’s energy demand growth exceeded global demand growth in 2018. According to the IEA’s Global Energy & CO2 Status Report, primary energy demand in India increased 4 percent, or over 35 million tons of oil equivalent. This represents 11 percent of global energy demand growth.

According to the BP Energy Outlook 2019 report, between 2017 and 2040, India will account for more than a quarter of global net demand growth for primary energy. The robust growth of wealth and population will lead to a massive increase in India’s primary energy consumption, which will increase by 1.2 billion tons of oil equivalent or 156% by 2040. This makes India by far the largest source of energy demand growth. With this absolute growth, India’s share of world primary energy demand will rise from today’s 6% to 11% by 2040. /9/

Key Highlights of the 2019 BP Energy Outlook Report

Global energy demand is expected to increase by about a third by 2040, reflecting improvements in living standards, particularly in India, China and throughout Asia. This is largely covered by natural gas, which will replace coal as the second largest source of energy by the mid-2020s, and is expected to approach oil by 2040.

Most of the growth in energy demand will come from fast-growing developing countries, led by India and China. Emerging economies will account for over 80 percent of global economic output, with India and China accounting for about half of this growth.

India will surpass China by the mid-2020s as the world’s largest energy growth market, accounting for more than a quarter of the growing global energy demand.

From 2018 to 2040, the Indian population will grow by more than 267 million people, and the economy will almost triple, meaning that per capita income will roughly double.

Power generation in the country will increase by 207% to 4,781 TWh by 2040, representing 61% of primary energy demand growth. Industry would be the strongest source of final energy demand growth (+238 tons oil equivalent, Mtoe), followed by transportation (+144 Mtoe).

Renewable energy use will increase from nearly 20 million toe to around 300 million toe by 2040, mainly concentrated in the energy sector and driven by the growth of solar capacity. Despite this growth in renewable energies, coal will continue to dominate the Indian power generation mix.

India would be the largest growth market for coal, with its share of global coal consumption more than doubling to about a quarter by 2040. Most of the growth would be used to meet robust growth in the energy sector.

Population growth and impact on plastic packaging

The Indian population is expected to rise from 1.37 billion in 2019 to 1.7 billion in 2047 (Source: Population Foundation of India). The urbanization of India would rise from 34.1% in 2018 to over 50% in 2047, increasing the urban population. The increasing population with increasing urbanization would provide enormous scope for the rising demand for plastic packaging in the country in the coming years. /10, 11, 12/

_____________________________________________________

Sources:

/1/ ASSOCHAM- EY Study- The Bib “W” impact : effective urban waste solutions in India- Date of Publication 14th Jan 2019

/4/ www.paceindia.org.in › docs › article1

/5/ https://cpcb.nic.in/annual-report.php

/6/ http://164.100.228.143:8080/sbm/content/ writereaddata/ SBM%20Plastic%20Waste%20Book.pdf

/9/ https://www.bp.com/en/global/corporate/ news-and-insights/press-releases/bp-energyoutlook-2019.html

/10/ http://worldpopulationreview.com/countries/ india-population/

/11/ https://www.worldometers.info/worldpopulation/india-population/

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.