Each industry, market or region bear their own specifics, the understanding of which is key to successful business. There are several important aspects to take into account in the “today” of Central-Eastern Europe, when considering trade or investment activities into the packaging industry.

As “Central-Eastern Europe” we refer to the countries that have, till 1989-90 been under the influence of the Soviet Union and have since then made their way into the economic system similar to the one in Western Europe. This apart from the countries of the Baltic states, which are definitely a part of the CEE, that have formed the Soviet Union and are on the other hand usually referred to as Eastern Europe – due to their continuing influence from Russia and forming of the CIS. It should be noted that the geographical centre of Europe as a continent is placed, depending on the method used, in either Lithuania, Latvia or Poland – noticeably Central-Eastern Europe.

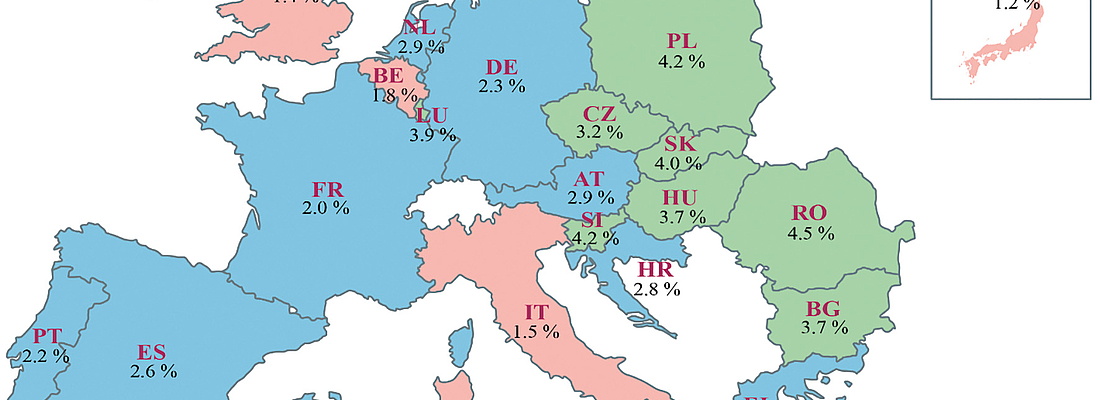

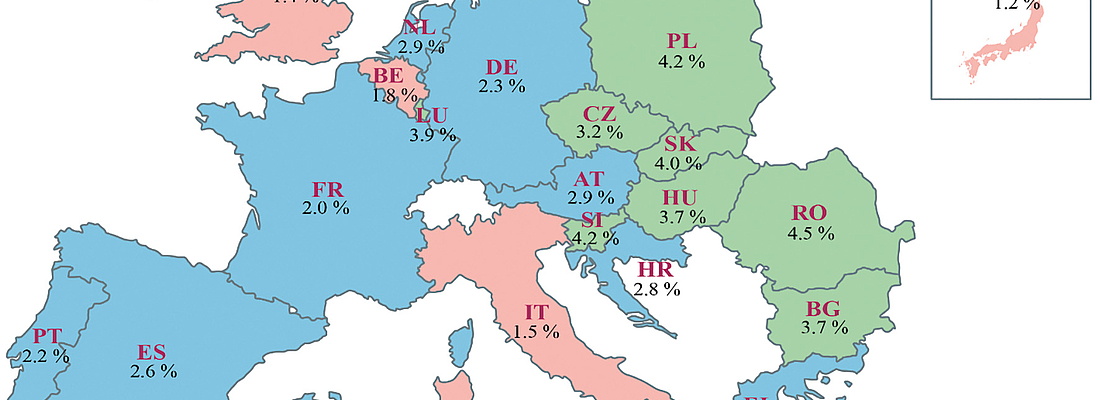

Fig 1: Expected real GDP growth for 2018 in EU Member States

In the early 90s most of the CEE countries have defined their will to adopt the Western political and economy system, meaning in short - private business and free trade. Most of them eventually managed their way and joined the family of European countries through various agreements, including joining the European Union and NATO. Still, one must take into account that these economies have been for many years governed by a completely different mindset. Central planning, the dictating role of the communistic parties and most of all – very little private ownership in businesses, did not place the Central-Eastern Europeans in a good starting position in the world, where the drivers are competition and growth.

This eventually lead in various industries, including packaging, to the domination of larger western corporations on the markets of CEE. In the PET filling industry it was Coca-Cola, Pepsico, Danone, Nestle, Bunge and others – purchasing multiple local mineral water and building their own CSD facilities. Other players included Alpla, Graham Packaging, Plastipak and more.

I would point out several key arguments that lead to the market success of local beverage bottlers:

-

¡ -Price vs demand tactics, targeted mainly to offer low priced products, in safe and large PET bottles.

-

¡ Marketing campaigns aimed to underline the “everlasting promotions”,

-

¡ Private connections with local authorities, sometimes beyond what would be considered “fair play”,

-

¡ And eventually, clever ways of acquiring and using the EU funds for technologies.

Nowadays, the PET container industry in CEE is considered modern, competitive and complying to all European standards in quality. And looking to spread it’s market presence from the app. 120million consumers within the region – to the western and eastern neighbours.

A good example here is the company Karlovarske mineralni vody, a.s. - the biggest producer of mineral and spring waters in the Czech Republic (brands: Mattoni, Dobra Voda, Magnesia, Aquila) and in the meantime, a co-owner of the Hungarian Szentkiralyi water. With over a 140 year of tradition, managed since the mid 1990-ies by the Italian Pasquale family, the company has grown to operate nowadays over 30 PET bottle lines – many of them with speeds over 25,000 bph. The water is exported to more than 20 countries worldwide.

The news on KMV acquiring the Pepsico bottling operations in Hungary, Bulgaria, Czech Republic and Slovakia – is very impressive. Isn’t this a sign of the times?

BEER IN PET

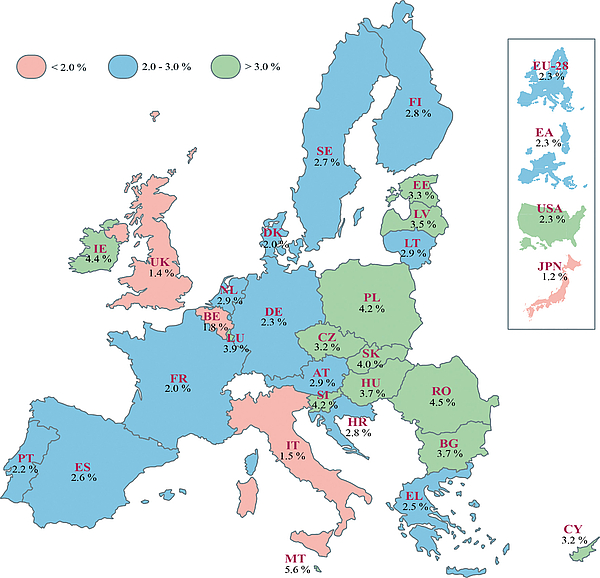

One of the most noteworthy observations when comparing the markets of CEE with Western Europe and other regions globally - is the high share of PET bottles among the packaging containers for beer.

Certainly the markets of Russia and Ukraine, although recently in downturn due to legislation, contribute to the large quantities. Within the CEE the dominance of PET to fill PET mainly seen in the southern countries of CEE – Romania, Bulgaria and the Balkans – countries where beer was not traditionally the leading alcoholic beverage and in many cases – established it’s market presence almost from scratch. Again – the reason for PET bottle dominance is the competitive price of 1,5-2,5 litre containers against glass and cans. Quality played in this matter a secondary role. Note that the majority of PET beer bottles in CEE are single-layer, but with a sufficient shelf life to make it through the logistics and outlets to the consumers.

Of course one has to keep in mind the fact the scale of beer PET bottle production – these are mainly 2-4 lines per brewery, blowmoulding machines with typically 10-16 moulds. Thus incomparable to the large scale of water or CSD packaging. Still, beer in PET remains a segment that will play a more significant role if another crisis looms.

CONCLUSION

Opportunity: growing GDP and salaries – as seen on the attached map - the green colour clearly shows today’s leaders in the GDP growth in Europe – and one can easily recognise the region we are talking about.

Challenge: workforce supply – a large number of qualified engineers, operators and specialists have found jobs in Western countries of the EU. This causes significant problems for the businesses in CEE to continue to operate with a low- cost workforce.

Solution: R&D and innovations. Businesses and governments of Central-Eastern Europe are now much more seriously supporting high-tech advancements, start-ups and innovative ways of increasing production, quality and sustainability. It will be a matter of years, or maybe even months, until we will see the newest automation, productivity and Industry 4.0 solutions – implemented earlier in Central Eastern Europe than anywhere else in the world.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.