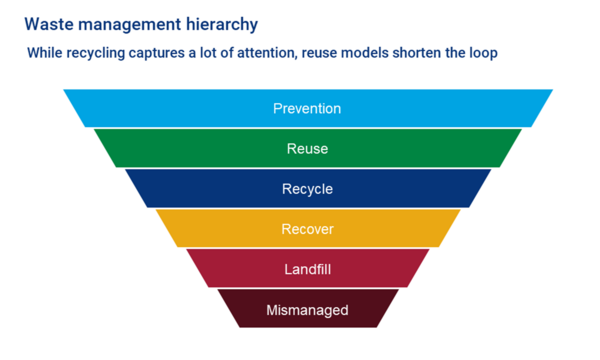

Right now, much of the debate about improving the sustainability of polymer value chains is about increasing recycling rates. Many plastic applications are damaged or contaminated after use and need to be reprocessed to bring them back into use. However, by doing away with the need to reprocess, reuse models are the more sustainable, circular solution.

A packaging value chain optimised for sustainability would, therefore, look to redesign the proportion of plastic packaging suitable for reusable applications.

Everyone needs to get on board for plastic reuse models to work

Reuse plays a marginal role in most packaging markets today. Germany is a notable exception, due to continuing obligations to use reusable or returnable single-use bottles for many types of beverages. The German Packaging Act was updated in May 2021, removing nearly all exceptions to these obligations, and mandating a re-usable alternative for packing takeaway food and drinks from 2023.

While Germany remains an outlier for now, other countries will be watching the impact of the updated Act with interest. If a success, other countries may follow suit, particularly those affected by the EU plastic tax.

Change won’t happen overnight. The penetration of reuse models will require coordination across a wide range of stakeholders. They will require the reorganisation of value chains to provide consumers with cost-effective, sustainable and, crucially, convenient packaging solutions. Logistics, technology, product design and communications all need to come together to secure market share for reuse models.

Reuse-induced polymer demand reduction could be significant

Change is underway, though, and momentum behind reuse models is growing. Companies are alert to the material and reputational benefits, and many consumer brands are experimenting with different approaches – from refillable shampoo bottles to reusable cups for takeaway coffee.

The impact will vary from market to market. Experimentation is – mostly, though not exclusively – concentrated in high-income economies right now, driven by consumer concerns, lower price sensitivity and regulatory trends. The commercialisation of these models is also likely to scale up in these markets first.

Penetration will also vary by application and polymer. Because of their high use in rigid packaging applications, polyethylene terephthalate (PET), polypropylene (PP) and polystyrene (PS) are most exposed to demand destruction from the shift to reuse models. We estimate that for select applications, polymer demand could decline by as much as 25%.

The full report explores reuse models and the impact on polymer demand in more detail. Fill in the form at the top of the page to access the preview brochure to find out more.

www.woodmac.com