Pepsi places its bets on mass marketing its energy drinks to democratise the category

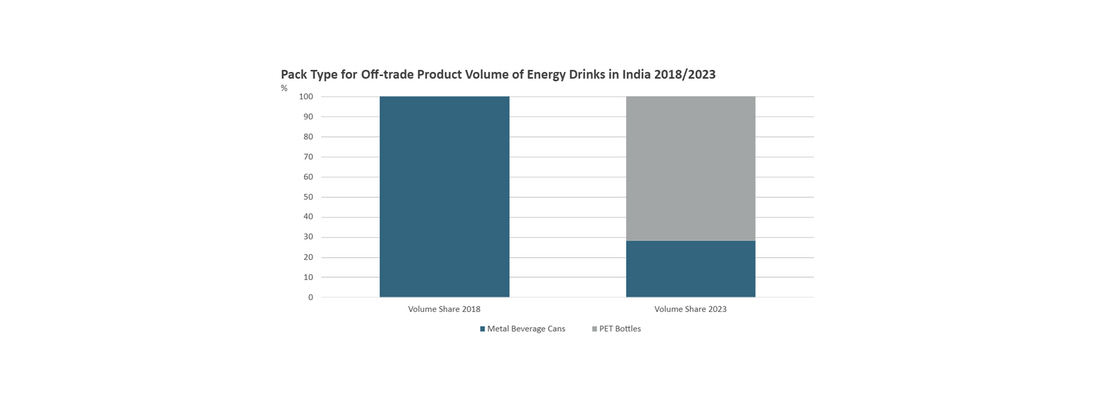

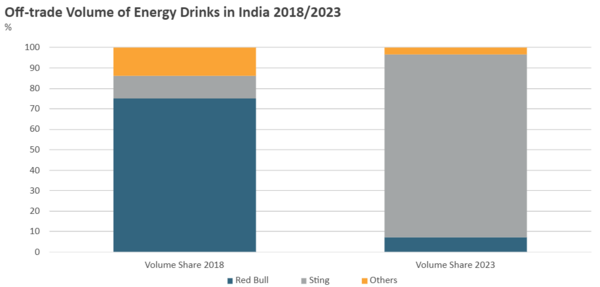

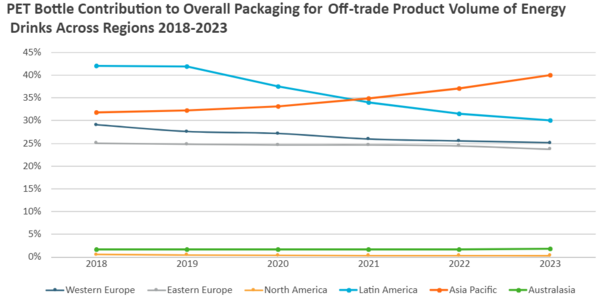

In 2017, PepsiCo entered with Sting energy drink, priced at INR50 per 250ml can, while Red Bull, the leading player, charged nearly double that for the same quantity. Realising the need for affordability to attract a broader consumer base and mine untapped potential in the category, particularly in rural areas, PepsiCo acted. In 2020, it introduced Sting in a 250ml PET bottle priced at INR20, focusing on accessibility. Coca-Cola followed suit in 2022, launching Thums Up Charged Berry Bolt, now changed to Charged, leveraging the strength of its established Thums Up carbonates brand. Both companies benefit from their extensive distribution networks, allowing them to reach consumers in urban and rural areas.