An interview with German Reichert, CEO of HANSA-HEEMANN AG, on the challenges of the German water market

HANSA-HEEMANN has a long company history. Where and when did it all begin?

Reichert: It all started with the Holsten Brewery. In the 1960s, the Bavaria St. Pauli Brewery on Hopfenstrasse in Hamburg’s St. Pauli district began to promote mineral water and distribute it under the brand St. Michaelis. That put the Holsten Brewery in a bit of a fix, as they also wanted to be a part of the mineral water segment. As a response, Holsten set up the mineral water brand hella. So the company has been in the market for over five decades. At the time, the annual per capita consumption of mineral water was under 30 litres, but nowadays it has reached 150 litres.

The brand name “hella” – your company’s most prominent drink – sounds like the woman’s name Hella?

Yes, that’s right. As a matter of fact, it does stem from the name of a former chairman’s wife. hella was bottled for the first time on the premises of the Holsten Brewery at the end of the 1960ies. Hansa Brunnen AG was founded in 2001 and the Heemann Group was acquired in 2004. The two were merged, finally becoming HANSA-HEEMANN AG in 2004. Both company names were incorporated into the new company name, which also helped the employees.

Our production site in Bruchsal went into operation in 2007. Our own packaging division followed in 2008, in other words, we started to produce our own PET preforms. The site in Bruchsal was further expanded in 2014. Today, the HANSA-HEEMANN Group operates at five locations; four production sites with an annual capacity of around 2 billion bottles filled, as well as our headquarters here in Rellingen. We are currently one of the leading suppliers of mineral water and soft drinks in Germany. But let’s go back to the beginning: It all started in the brewery with the two brands “hella” and “St. Michaelis”.

You just described how the company moved from being a bottling company to include packaging production. Do you see HANSA-HEEMANN primarily as a bottling company or as a packaging manufacturer today?

Interesting question. Mineral water is a product which of course constitutes a drink, but also includes packaging. We see ourselves as manufacturers of mineral water and soft drinks. In order to stay competitive in this segment, we had to produce our own packaging. As a bottling company, we have always worked with highly efficient machines and filling lines, and ultimately also with production sites that possess the expertise and the ability to navigate this competitive environment. In order to be economically successful, packaging must be given a high priority. The same applies for the availability and deliverability of our products and processes.

The trend of lightweighting also places a focus on saving energy and sustainability. Are you pulling out all stops in this area as well?

I doubt it, there is always the potential to do more. As I have mentioned, our business model involves manufacturing our own packaging. This means also that we do our own packaging development – in other words, we work intensively on making our packaging more sustainable. Using recycled materials to make sustainable, eco-friendly bottles is only one aspect to be considered, of course. The exemplary German deposit system keeps people from littering, and at the same time enables the industry to reuse a raw material – as single-origin as possible. As this can have an important ecological effect we take this into account in our packaging design. Sustainability also involves considerations of social aspects and the high quality reproducibility of our products in the economic climate.

Does the consumer play a role in packaging for discount stores?

Packaging is an essential selling point. In Germany, the market share of PET one-way packaging has now reached around 60%. One-way packaging enables us to be part of various distribution channels at the same time. Discussions around packaging weight are still very much driven by cost, rather than by a holistic approach. When I say ‘holistic’,

I mean also focussing on the consumer: Holding, opening, handling the bottles – the whole sensory experience. In my opinion, we are already over the peak of this development. Just consider the elderly, or people with a physical handicap for example, and imagine how difficult it can be to open a bottle, or how pouring is only possible using both hands because the bottle is otherwise too unstable. When this happens, we have made a mistake, in my view, even if we have reduced the weight of a 1.5l bottle to as little 24g. When mineral water bottles are more like “PET bags”, I share many consumer’s lack of acceptance. Of course, ecological aspects also play a major role, even if consumer interest in sustainability is – in our opinion – already waning.

“when mineral water bottles are more like “PET bags”, I share many consumer’s lack of acceptance.“

You just referred to different distribution channels. Which do you operate?

In addition to one-way bottles, refillable and glass containers are of course crucial for us. Mineral water in PET bottles still does not sell very well in bars and restaurants in Germany, where glass bottles are preferred instead. Different consumer needs require different types of packaging, which is also true in the PET segment. In the out-of-home market, there is a rising demand for small-volume containers, while consumers use larger units at home. For this reason, the range of products is growing considerably.

What do you think about the current discussion of one-way or refillable bottles?

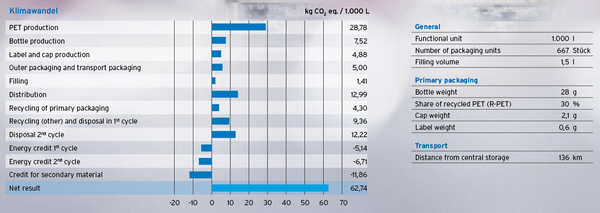

As part of the BVE (the Federation of German Food and Drink Industries), the project group “Consumer and Ecology-oriented Drinks Packaging” (AKÖG) aims to facilitate a fact-based discussion on the topic of “one-way - refillable bottles”. Working together with the ifeu Institute in Heidelberg, it has developed industry-wide criteria for reducing the CO2 footprint of a PET bottle. The CO2 footprint can be reduced on the basis of four concrete criteria. These include packaging weight, percentage of recycled materials used, distribution distance and energy consumed in manufacturing. We are part of this project group, which has made it possible to move PET packaging forward in terms of its ecological impact, and bring it up to a similar level to refillable packaging. The standard developed is reviewed and revised at regular intervals. The RAL quality association for PET drinks packaging was set up to improve the quality of the recycled material used, by ensuring and stipulating quality at the interface between disposers, recyclers, preform manufacturers and fillers.

The advertising slogan “water is life” is currently prominently displayed on the HANSA-HEEMANN website. What expectations does this place on your company?

“Water is life”: Yes, this is our area of expertise. Our mineral water comes from protected underground springs and it is bottled directly at the source. It undergoes extensive external and internal quality control measures, which attests to our high expectations of our products. Mineral water is water of particularly high quality, which has not been processed. Nowadays, water is also a “mobile drink” – which poses certain challenges for us. If we always have mineral water with us – on the way to school, at work, when playing sport – then the packaging is also always with us. The necessity of being mobile influences the packaging size, prompting a tendency for packaging to become smaller. Food and drinks play a crucial role among the mega-trends in industrialised nations – globalisation, demographic changes, availability of resources, high commitment to quality. We are part of all of these trends

“We depend on availability and deliverability”

You just referred to different distribution channels. Which do you operate?

In addition to one-way bottles, refillable and glass containers are of course crucial for us. Mineral water in PET bottles still does not sell very well in bars and restaurants in Germany, where glass bottles are preferred instead. Different consumer needs require different types of packaging, which is also true in the PET segment. In the out-of-home market, there is a rising demand for small-volume containers, while consumers use larger units at home. For this reason, the range of products is growing considerably.

What do you think about the current discussion of one-way or refillable bottles?

As part of the BVE (the Federation of German Food and Drink Industries), the project group “Consumer and Ecology-oriented Drinks Packaging” (AKÖG) aims to facilitate a fact-based discussion on the topic of “one-way - refillable bottles”. Working together with the ifeu Institute in Heidelberg, it has developed industry-wide criteria for reducing the CO2 footprint of a PET bottle. The CO2 footprint can be reduced on the basis of four concrete criteria. These include packaging weight, percentage of recycled materials used, distribution distance and energy consumed in manufacturing. We are part of this project group, which has made it possible to move PET packaging forward in terms of its ecological impact, and bring it up to a similar level to refillable packaging. The standard developed is reviewed and revised at regular intervals. The RAL quality association for PET drinks packaging was set up to improve the quality of the recycled material used, by ensuring and stipulating quality at the interface between disposers, recyclers, preform manufacturers and fillers.

The advertising slogan “water is life” is currently prominently displayed on the HANSA-HEEMANN website. What expectations does this place on your company?

“Water is life”: Yes, this is our area of expertise. Our mineral water comes from protected underground springs and it is bottled directly at the source. It undergoes extensive external and internal quality control measures, which attests to our high expectations of our products. Mineral water is water of particularly high quality, which has not been processed. Nowadays, water is also a “mobile drink” – which poses certain challenges for us. If we always have mineral water with us – on the way to school, at work, when playing sport – then the packaging is also always with us. The necessity of being mobile influences the packaging size, prompting a tendency for packaging to become smaller. Food and drinks play a crucial role among the mega-trends in industrialised nations – globalisation, demographic changes, availability of resources, high commitment to quality. We are part of all of these trends

So you see the mineral water market as stable?

I think that the market will continue to grow, even though the current per capita consumption of 150l is already high. Yes, I think the mineral water market – despite all of its challenges – is a stable market, a stable segment, which is not particularly susceptible to crises. It is a market which comes under pressure now and again, but generally it tends to move in a positive direction. Of course, it is always worth keeping an eye on other aspects for the competitiveness of our company.

Which aspects are those?

It’s all about cost leadership and innovative power. We are constantly focussing on these aspects, although they are conflicting priorities. Innovations usually initially lead to an increase in complexity, and therefore a decrease in cost leadership. In the mid and long-term, innovations must restore cost leadership. If we do not manage this, then we will use market share. That is why we don’t just regularly review our processes, but our packaging, too.

Are the smaller mineral springs slowly beginning to go under?

In the German market, there are over 200 mineral springs and around 500 different brands of mineral water. The entry-level price segment is shared between a few large suppliers in Germany at the moment. In addition to international and national brands, the market celebrates regional diversity. I am always pleased if the diversity among regional companies and brands is clear to see at the German Mineral Springs Association annual conference. Thanks to the German Mineral Springs Association statistics, we know that the smaller springs are currently growing with PET one-way packaging. Admittedly, this is happening at a regional level, but it is nonetheless noteworthy. I think it is difficult to enter the mass market as a newcomer and to be successful, as developing water sources and modelling efficient processes require considerable commitment and stamina.

Fig. 1: C02 calculator in the PET filling process

Source: HANSA-HEEMANN AG/ifeu

Is it just as difficult for newcomers in regional segments? It sounds a bit like territorial protection. If so, does that not inhibit innovation resulting in interesting new products?

The markets in Germany are determined by their competitiveness. There is no territorial protection in this industry. On the contrary, in Germany in particular, the diversity of mineral springs is leading to a wide range of mineral waters with a variety of mineral contents and tastes, as well as different packaging lines and systems. It is this diversity that makes our market so interesting and gives consumers the opportunity to choose the best product for them.

What is the situation for our neighbours, or across Europe? Do they also see a few big businesses sharing the discounter market?

Germany has one of the largest market shares occupied by discounters. Consumers have benefitted from this development in recent years. As well as low prices for food and drinks, they offer high-quality products. This development is also now taking hold in Europe. German traders in particular have managed to achieve considerable success in Europe and to constantly expand their market shares.

What about product innovations in the area of water? Have German bottling companies rested on their laurels for too long?

Far from it. The developments over the last 15 years have shown how innovative our market can be. Just looking at the market development in PET one-way containers, which has grown from a meagre share of the market at the end of the 1990s to a current share of 60%, demonstrates the breath-taking velocity of the market. Another example are the innovations involved in the continuous reduction in packaging weight. The efforts made across the whole industry regarding sustainability are an indication of a dynamic market. The constant development of new flavours in the soft drink segment complete the picture.

Where do you think the current and future requirements of the market lie?

Well, this leads us to our main strategic activity. There is one particular challenge at a societal level. I’m talking about the shortage of skilled workers, an issue which does not only affect the drinks industry. I would go as far as to say that we could actually grow even more quickly if we had access to the necessary resources. Our society is becoming increasingly academic, and this is making it harder to find a basic supply of skilled workers. For this reason, integrating refugees is also an important topic for our company; in my opinion, it is a real opportunity. Despite the relatively modest size of our company, we currently employ people from 31 different nationalities, which brings its own challenges. At the same time, we have to appreciate the engineering and the technological breakthroughs and developments. Where are we headed, also considering aspects of digitalisation? Who will be able to operate the machines, the plants? Which qualifications are necessary? Let’s compare the situation with the automotive industry. In years gone by, a technically-able driver would be able to repair their own car, and maybe even change the engine. That is simply no longer possible. The complexity of our plants has also increased so dramatically that even trained electricians or fitters are not always able to solve all of the problems – aside from the fact that this sort of skilled worker is very difficult to find nowadays.

When you advertise positions, how many applications do you receive?

It seems to me that people tend to avoid scientific and technical subjects. Just a few examples: When we advertise a position in Marketing, we receive 300 applications, around 200 for a position in Controlling and not even 20 applications for a position in Engineering or IT. Even though the subject on everyone’s lips is: Digitalisation. I see great difficulties in actively pursuing digitalisation or Industry 4.0 in general, given the standard of training at the moment, or rather due to the graduation figures for technical professions.

On the other hand, is not true that digitalisation or Industry 4.0 will make it easier to get by with fewer personnel?

Digitalisation is an incredibly exciting topic. Strictly speaking, it is related to the organisation of processes. Winning over the managers, the employees, the whole organisation takes great initial efforts. Data, data quality, data collection and data management play a crucial role. Data must be generated and presented in such a way that processes can run more efficiently.

When you invest in a new machine, you know how much less energy it is going to consume, or how much greater its performance will be. This enables you to quickly measure and calculate the benefits; with digitalisation, it is difficult to predict the economic effects.

But I see it as something positive on the horizon. I can imagine that the future generation of managers, who already organized themselves differently during their youth and work in networks, will really contribute something valuable here. A small example: If I am in an unknown city, I like to follow a map. However my sons whip out their smartphones – and leave me trailing in their wake on the way from A to B

What concrete steps need to be taken in the short and long-term in order to continue meeting the market requirements of the future?

A clear answer: To optimize and communicate data streams and commodity flows, including with customers, suppliers and subcontractors.

What is your vision for the ideal filling/production line? Or in other words: Where do you currently see shortcomings which cannot be remedied with today’s solutions?

I think there is potential to step up plant availability amidst increasing complexity. Digitalisation can also help here. Let’s take a production site with maybe seven filling lines as an example. Even now, data are available from monitoring of the individual systems – however, a speedy analysis of the data is not yet possible. Or let’s take quality control: Measuring bottle wall thickness, section weight, that is cutting bottles and weighing sections, takes too long at the current output rate. We also need to get to the bottom of topics concerning availability and maintenance. Take the example of the stretch-blow moulding machine: Machine performance has doubled in the last ten years, however this did not mean that the service provided by machine manufacturers, or the service friendliness of the plants also improved in the same degree. This is why I believe we are still a long way from the best possible plant availability. Plant manufacturers are still having trouble in this area. It appears that the necessary skills are not always available to the necessary extent. To put it bluntly: “Ensuring availability and deliverability is no piece of cake nowadays.”

“Ensuring reliability and deliverability is no piece of cake nowadays”

With a view to sustainability and the product as a whole, where do you see potential for the continued development of PET bottles?

There are four significant areas for the ecological PET bottle: weight, distribution distance, percentage of recycled materials used and process efficiency. These are the control buttons for manufacturing the most sustainable packaging possible. For us, this means using decentralized production structures so that we can supply regionally, but at the same time enabling us to reach a production quantity and capacity utilisation which enables us to achieve process excellence.

Together with the ifeu Institute, we have developed a simulation or a way of modelling the CO2 footprint, which should lead to the development of the optimal PET bottle. It allows us to determine the CO2 emissions for 1000 litres of mineral water using our control criteria, regardless of the production site or the customer. Thanks to these criteria, processes optimization can be measured. (See figure 1).

What about PET recycling at your facilities? Do you see any advantages in implementing your “own” material cycle?

You are alluding to the fact that Lidl has set up their own material cycle at a recycling plant near the German city of Aachen. That does not put us under any pressure. It would put us under pressure if we were not in a position to cover our demand. We are working on more sustainable packaging. The percentage of recycled materials used is an important variable, which affects our entire preform production, the system dryer/units etc. Of course, the prices for recycling – and for virgin resin – need to be constantly monitored; everyone knows that there is a wide price range for materials. We easily meet our demand for recyclable materials; together with our partners, we have this under control.

So you have never considered implementing your “own” material cycle?

The industry did intend to build a closed model with customers, but the original interest was never taken any further. Of course, now and again we discuss the possibility of an in-house recycling plant.

What is your growth strategy for the coming five years?

Growth is one of the strategic targets, and we consider it as part of our “Refreshment for everyone, every single day” objective. We have seen successful growth through trade brands and own brands, and we will see continued growth with our product innovations. In addition to the wide range of flavours, diverse packaging tailored to the wishes of our consumers is also an important factor. Some of our core questions are: Where can we generate growth? And what suits us? The availability of mineral water resources is very limited. Even tapping a new source at an existing location can take up to four years. This means that creativity is in demand.

Mr Reichert, thank you for talking to us.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.