Healthy Living Trend

The healthy living trend and its influence on product and packaging choices

In this contribution to comPETence magazine, we examine the global healthy living trend and how it is influencing global food and drink and packaging trends, with emphasis placed on soft drinks given this industry’s importance to the PET industry. According to Euromonitor International research, soft drinks applications accounted for 88% of global retail PET bottle sales in 2018.

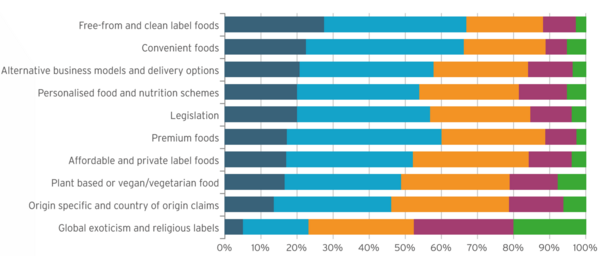

Fig 1: Trends Expected to Impact Packaged Food Sales in Next Five Years. (Source: Euromonitor International Packaged Food Industry Insights survey, May 2018)

Pursuit of healthy lifestyles sees a rise in demand for natural and clean labels…

Across food and beverages, health is progressively becoming a core influencer on consumers’ path to purchase. Euromonitor’s 2018 Packaged Foods Industry Insights survey signposted ‘free-from and clean-label’ as most influential for the food industry, with ‘premium foods’ ‘personalised food and nutrition’, ‘plant-based or vegan/ vegetarian food’ and ‘origin specific and country of origin claims’ also among the top trends. This underlines the significance that products with health and quality credentials will hold for consumers who seek to take better care of their health and wellbeing.

…and less sugar

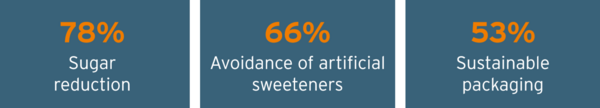

‘Sugar-reduction’ has been cited as the primary preoccupation of the soft drinks industry for the coming year, as indicated by Euromonitor’s 2018 Soft Drinks Industry Insights Survey, where 78% of respondents cited sugar reduction as either ‘extremely influential’ or ‘very influential’ for the soft drinks industry.

This was followed by ‘avoidance of artificial sweeteners’ as the second most influential trend, again illustrating the importance of health credentials to soft drinks’ onward development. The need for sustainable packaging was also confirmed as the third most influential trend amongst soft drinks industry professionals. It will be important for product, ingredient and packaging innovations to align to these health-driven needs.

Importance of the right pack size for convenience and health

Packaging plays an important role as brands employ pack sizing strategies to provide consumers with healthy portion sizes that align with changing consumption habits, such as for snacking (that is now a distinct consumption occasion of its own) and additionally confer the highly-valued ‘convenience’ attribute.

Across many food products, packaging unit volume sales growth widely outperforms food volume growth - evident in confectionery, dairy, savoury snacks, baked goods – indicating a consumer shift to smaller portion sizes as ‘healthy’ product options. Global packaged food sales (tonnes) rose 1.8% whilst global packaging sales (million units) for the packaged foods industry rose 2.5% in 2018. Within chocolate confectionery and savoury snacks, traditional preserves of the single-serve pack, there remains growth, but this is tempered by consumers’ search for alternative snack solutions and presents opportunities for portion packs across dairy (including non-dairy alternatives), snack bars and baby food.

Fig 2: Most Influential Trends in the Soft Drinks Industry for the Coming Year. (Source: Results from Euromonitor International’s Non-Alcoholic Drinks Industry Insights Survey, May 2018)

Regulatory influences continue: from sub-200 calorie confectionery…

With the rise in prevalence of lifestylerelated health issues – including diabetes, obesity and heart disease – governments and regulatory bodies are further exerting influence to aid portion control.

In the US, where 37.9% of the adult population in 2017 was classed as obese, a figure that is rising, the FDA has targeted the confectionery industry to ensure that, by 2022, half of all confectionery is sold in packs of 200 calories or less and for this to be clearly labelled on-pack.

More recently, the state of California introduced a healthy kids’ meal bill, the first of its kind in the US requiring healthy options such as water or milk to be the default beverage in foodservice outlets. Products that respond on calorie and nutritional value needs can enjoy success - Californian Halo Top is one successful launch of a ‘healthy’ ice cream treat that is low in calories and high in protein.

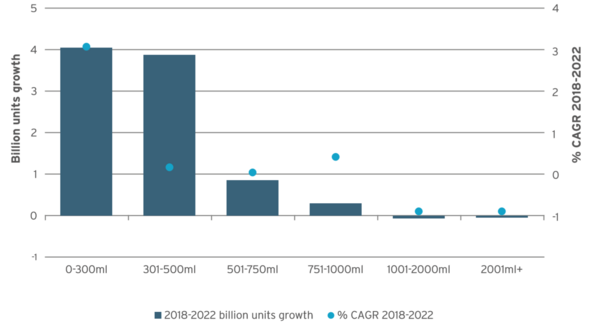

Fig 3: Global Carbonates Packaging: Forecast by Pack Size Band 2018-2022

…to the sugar tax that calls for moderation in soft drinks

Sugar taxation has been implemented across many countries, as a motivation and pressure to improve public health, by reducing consumption of sugar. Over 2017-2018, the UK, Ireland, South Africa, Turkey, Saudi Arabia and UAE joined the countries that have already introduced levies on sugar-sweetened beverages.

The response from brands to the sugar levies? It has been varied. There has certainly been much activity by brands to mitigate the impact of the sugar tax. In carbonated soft drinks and energy drinks, key targets of the tax, brands have responded in several ways, including, by:

- Reducing sugar content and tax levy implications via product reformulation, through use of high-intensity, lowcalorie sweeteners;

- Introducing sugar-free variants to ranges, for example, Coca-Cola’s launches in the UK for the Monster brand, also Sprite Zero;

- Introducing a range of smaller pack sizes, to reduce portion size, and so lower the calorific/sugar content and retail pack price. The April 2018 sugar tax introduction in the UK coincided with Coca-Cola reducing the size of its take-home bottles of Coca-Cola Classic from 1.75litres to 1.5litres, its single-serve PET bottle from 500ml to 375ml and the introduction of a new 250ml can.

Governments’ intervention via sugar taxation to help curb sugar consumption, will likely further expand to other countries.

The Malaysian government, whose nation has recorded one of the highest increases in diabetes prevalence over the decade spanning 2007 to 2017, is considering a tax on sugar-sweetened drinks. To address the rising health-awareness in Malaysia, The Coca-Cola Company, introduced in 2017, a 330ml bottle to replace the larger 390ml PET bottle.

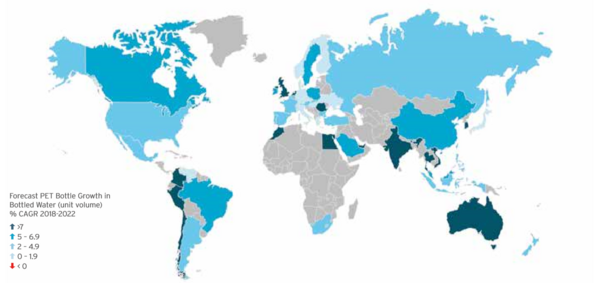

Fig 4: Forecast Growth for PET Bottles in Bottled Water 2018-2022

Note: Data refers to PET bottle growth in bottled water by country (retail unit volume growth % CAGR 2018-2022

Pack downsizing for health: carbonates

Results can be seen already as the 0-300ml size range is the most dynamically performing in retail sales over 2017-2018 and is also forecast to see the strongest onward performance to 2022, at a 4% CAGR, reflective of the pack down-sizing trend enabling consumers to moderate their intake of traditional sugar carbonates, even to regard it as an indulgence.

Interestingly, the health trend is procuring development of the addedvalue niche of premium carbonates that have natural flavours and botanical profiles, as the performance from brands such as Fever Tree indicate - this brand expanding its range with lighter (less sugar) variants in 2018 to increase the provision of healthy beverage choices.

Likewise, Cawston Press extended its range by introducing a new formulation containing no added sugar, with a beverage can of 99-calories whilst in Mexico, Grupo Peñafiel (Dr Pepper Snapple Group Inc) expanded its Peñafiel range with plantbased flavour ‘Peñafiel con Agua de Coco’ - a carbonated spring water with coconut water, bringing the stellar coconut water performer into carbonates as a healthoriented beverage option.

Over 2017-2018, better for you reduced sugar beverages recorded global value growth of 3.7% whilst the overall carbonated soft drinks category recorded growth of just 0.8% over the same timeframe; this will be a continuing theme in response to the healthier lifestyle trend.

Pack size reduction is not restricted to single-serve purchases of carbonated soft drinks. In France, there is replacement noted of some 2-litre, 1.5-litre and 1-litre pack sizes with 1.75-litre, 1.25-litre and 900ml packs, respectively, as a lighter to carry purchase from convenience stores and small supermarkets, and compatible with the more regular shopping experience, itself gaining traction over the big hypermarket shop.

In Germany too, amongst multi-serve sizes, there is a preference at the lower end of pack size range, for 750ml-1.5- litre packs in place of 1.5-2-litre pack sizes, further indicative of a reducing consumption trend.

Bottled water: the wellness winner for PET

Bottled water continues to make gains on wellness grounds, taking share from carbonates, and procures strong growth for PET bottles as the monopoly pack format for water. Bottled water is the single biggest category end-use for PET bottles and amongst the most buoyantperforming for PET.

The shift from tap to still bottled water across Asia (including China, Indonesia and India) remains significant, for essential safe-drinking needs and is bolstered by economic growth and the increase in consumption of bottled water across smaller towns and cities as a convenient on-the-go purchase.

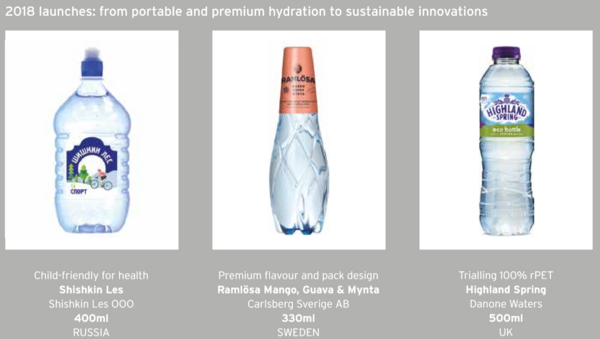

New launches, such as those targeting children, as seen in recent Russian label designs, from Shishkin Les (number two still bottled water brand in Russia) in early 2018, is adding to PET growth.

According to Euromonitor International’s research, bottled water is forecast to account for 68% of global PET bottle retail sales between 2018 and 2022. Healthier drinking habits the world over, is a key driver for the rise in water and water-like beverages being purchased over sugary soft drinks, providing consumers with a natural and low/nocalorie option.

Carbonated waters are seeing an uptick in sales, as an alternative to carbonated soft drinks - La Croix in the US being a particularly strong example of this with flavour variants, illustrative too of the continuing blurring of categories as flavour and functional benefits become more commonplace in water and as low/no-sugar variants expand reach in carbonated soft drinks.

Health as a key driver in product and packaging development

The value placed on health attributes as part of consumers’ product purchases will be instrumental to onward consumer product development and purchase, and this extends far beyond food and drink as health-inspired products are also increasingly sought-after as part of preventive beauty routines for skinhealth, to combat daily aggressors of pollution and stress. New beauty launches increasingly feature healthrelated claims. Further, vegan health as a lifestyle choice is emerging and translating to ethical cruelty-free vegan foods, vegan ingredients, also vegan beauty and creating interest in ethical or vegan-friendly packaging.

This underlines the importance that ethical, sustainable packaging solutions, across the consumer product landscape will have, together with product formulation and ingredients sourcing, to address the needs of an increasingly health-conscious and ethical consumer.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.