Gerd Liebig, Christoph Wynands, Arnaud Nomblot (from left to right, Photo credit: PETnology)

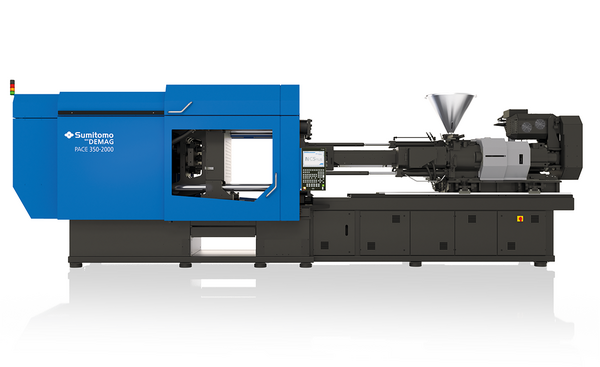

THE ALL-ELECTRIC PAC-E

Sumitomo (SHI) Demag's all-electric PAC-E: quick injection, quick to market

Sumitomo (SHI) Demag’s focus on machinery and technology in turbulent times - Interview with Gerd Liebig, Arnaud Nomblot and Christoph Wynands Sumitomo (SHI) Demag

In January we had an appointment at Sumitomo (SHI) Demag in Schwaig/Germany and met Gerd Liebig (CEO), Arnaud Nomblot (Director - Business Development Packaging) and Christoph Wynands (Product Manager Packaging). The conversation was about markets and crises, about innovations and market development, locations and personnel and of course about the new PAC-E and the system idea.

Markets and industries

You serve the automotive, consumer, electronics, medical technology and packaging industries. Where are your focal points?

Liebig: From a technological point of view, we are very busy with high-performance packaging. Standard is not necessarily our topic. In the highperformance sector, we have achieved a good market position in recent years, which is closely linked to the development of our all-electric machine and our high level of expertise in this area. Always keeping an eye on the cycle time and injection speed - that’s what drives us - and so we are very strong in the thin-wall technology sector and, in parallel, we were also able to make substantial gains in the closure cap sector - as you saw at the Drinktec and the K show last autumn. The medical sector is also important for us, as there is a solid proximity to electrical machinery here and synergies in pharmaceutical packaging.

Nomblot: With about one third of our machines, packaging is our main focus. Our R&D activities in the last six or seven years have essentially revolved around packaging and the all-electric PAC-E machine. These were and are our two major priorities. Now we are increasingly getting involved in the medical sector, and for the automotive sector we are hoping that the market will develop a bit more in the direction of electrical machines, and then we will do more there as well.

Liebig: Yes, we have some catching up to do. Since the pandemic, the market for challenging consumables and thus high-performance applications has increased significantly; until then, medical in the USA was a market strongly characterised by standardised machines. The demand has risen considerably and we are also noticing a significant increase in enquiries for our solutions.

Nomblot: The markets are all very different in terms of their requirements. For us, automotive accounted for about 40% for a long time; today our focus is packaging and medical although in Automotive we cover interior, lighting and electronic applications. Medical technology was around 5% for many years in the market. It is now rising more strongly, accounting for about 20% at its peak. We expect it to level off at about 15%.

Does this mean that the allelectric machine is the focus for all industries? Where does this focus come from?

Liebig: Our Japanese owner has shifted the focus to the all-electric machine and positioned it prominently at the heart of our company. Seven years ago, we made the strategic decision to completely design one of our plants, in Wiehe in Thuringia, for the all-electric machine. At the time - let’s stay in the picture - I took a good beating from the sales department. It was quite a confrontation. We pushed it through: Today we are the market leader for all-electric machines in Europe and were able to significantly improve our market share again in the second half of the year. This gives us a powerful market position; I suspect number one in packaging. But let’s be honest: we are suffering a little now because the PAC-E development took us a lot of time.

Good things take time?

Liebig: Well, yes (laughs). Contrary to our development principles - we usually take one step at a time in a very targeted way - we decided with our Japanese colleagues to move with the PAC-E into the implementation phase a little earlier and thus parallel into the market. We have high hopes for the product, based on the very high performance and the low energy consumption; here we excellently meet the trend towards energy saving.

When did you start developing the PAC-E?

Nomblot: About five years ago, we saw the basis for the machine at Sumitomo in Japan. At that time, our customers put pressure on us, wanting us to push ahead with the development of the allelectric machine. Right at the beginning, we had one hurdle to overcome - the performance of the El-Exis SP.

Liebig: No machine on the market had this level of performance. Our challenge: If we bring something new to the market, it has to perform at least as well. So our main development topics were squeezing out the last tenths of a second, ensuring the machine has a long service life and good energy consumption. Now we did it. The machine is fully electric and clean; the mould movements are just as fast as on the El-Exis SP, and we have achieved the same performance in terms of injection dynamics. All this with a fully electric drive. The main reason for this success is the Sumitomo group’s in-house motor development and production.

_______________

''We have high hopes for the product, based on the very high performance and the low energy consumption.'' - Gerd Liebig

_______________

Does this in-house motor development and production set you apart from competitors?

Liebig: Yes, our own all-electric technology is our unique selling point: our own motors and our own drives. Only Sumitomo has expertise in direct electric drive on the market.

After several years of development, you presented the PAC-E 2022 at the major packaging exhibitions.

Wynands: Yes, at Drinktec and K 2022. The first prototype was built in Japan. Since June last year, we have sent the first machines to field tests in Asia and Europe. The machine we showed at Drinktec was one of the prototypes.

Liebig: The PAC-E is a joint development of the Sumitomo teams in Japan and Germany: we brought in all the mechanical and packaging expertise from Germany and then integrated the all-electric expertise from Japan.

Did you initiate the development of these drives specifically for the PAC-E?

Liebig: Our motors are generally developed for the injection moulding process. So it goes into the breadth of the product range. We have been using the principle technology for years. Last October, we celebrated the 80,000th allelectric injection moulding machine at the K trade fair. Of course, adjustments were made for the PAC-E to achieve this top performance.

Nomblot: It is a motor manufactured for electric machines that enables high cost and performance benefits. The standard motors that are usually used are not optimised exclusively for injection moulding machines. What we have contributed in terms of injection moulding know-how has been translated into motor performance for precisely this injection moulding process.

Wynands: The IntElect series and also our machines from Japan have their own direct drives.

Liebig: Thanks to the success of the allelectric machine, we are now the third largest injection moulding machine manufacturer. We deliver about 7,000 machines a year, of which about 6,000 are all-electric.

At the K-Show, the PAC-E produced closures. Is the machine also suitable for other products?

Nomblot: The PAC-E is a pure highspeed machine. It will be used for thinwalled packaging, medical applications and closures.

Liebig: What we have achieved together in our development departments in Germany and Japan with this machine development is sensational. With the complete model range, this development opens the door to the market for us - and for me personally it is something extraordinary: I have been in the industry for 32 years now and have experienced a lot, but when I saw the machine in operation for the first time with its impressive performance and stability, it was an emotional moment.

The term “parallel” was mentioned earlier. Does that mean you are launching the PAC-E on the market and still have topics that you want to develop further?

Liebig: Yes, we presented the product early on. Our message: all-electric at the high end. That generated demand, which we now have to serve. The development period was relatively long. And that has nothing to do with uncertainties about performance or quality.

What slowed you down?

Liebig: Like everyone, we suffered from the global economic situation: material availability, especially for microchips, the pandemic with all its effects, difficult communication. But it was always clear to us that we would be successful in the end, but it took a while. In the end, we were pretty amazed that we succeeded in making the prototype so stable in terms of process control and that it also works so well in terms of energy. The result of the successful development is confidence, which leads to the fact that we are now simply manufacturing a few machines in advance to take the pressure off.

In an environment of high energy prices and price trends, it is of course a huge advantage that the new machine is performing so well. What is the response from the market?

Liebig: We are all experiencing a special situation today. The packaging market depends on consumption and is actually quite stable. Of course, current conditions such as the pandemic, energy costs or even the economic situation of consumers are affecting the markets. And on the technical side, too, specific topics determine the agility in the market, such as material costs, circular economy and, yes, also the question: What is the future of packaging? Our forecast was more positive; all in all, all these issues have reduced demand in 2022. Uncertainties were felt almost everywhere. Finally, there is the war in Ukraine with all the human suffering and its economic impact.

Do you expect barriers to investment to continue?

Liebig: You have to look at it in a differentiated way. These are indeed challenging times. I have recently been on the phone a lot with our customers; many of them - especially from the automotive industry - seemed depressed, in autumn for example because of the energy prices. But: I am a market person; I originally come from market research and love to deal with forecasts for the next four or five quarters. I believe that the market weakness will continue for another 2-3 months, then we will see strong growth impulses, especially from the automotive and consumer sectors.

Crises, innovation, market development

Meeting strong demand requires capacities and functioning supply chains.

Liebig: Yes, the industry is currently in crisis mode; it’s all about costs, costs, costs. We strive to keep innovating and building capacity. I expect the supply chains to stabilise in two or three months. Two months ago, the situation was very different. Here’s a comparison: in 2018, for example, customer utilisation of our machines was low. Currently, the utilisation of our machines is extremely high. We have the highest service turnover in the history of this company. But customers have been cautious about investing in machines for about four years. From my market observations, I conclude that consumption will pick up - and then we will be ready.

When you expand capacities, does that mean more production here at the Schwaig site or also in China, for example - for the Chinese/Asian market?

Liebig: We have decided to manufacture our IntElect also in China in 2023. We are hoping for impulses so that we may have an electric machine with which we can also score in the consumer sector in two or three years. So it’s less about costs and more about strategic orientation. We are currently producing the IntElect in Japan, China and Germany. Whereas recently we were not able to accept large orders, with the new set-up we can also serve large demands of 100 machines.

You say that you are focusing on packaging and all-electric in R&D. What is it about in particular?

Nomblot: In the packaging sector, it’s all about the system approach. Here it is more pronounced compared to electronics or automotive. We see the customers and their need to manufacture specific products - and score points with our expertise: we think in terms of application, we know mouldmaking, we know automation, and we can translate a product into machine options. And yes, speed is a requirement for development: it has to go faster and faster. This applies to the machine and to the development itself. Overridingly, energy efficiency is clearly the main issue - along with the cleanliness of the machines.

What does “clean” mean? Does it also mean easy to maintain?

Nomblot: The customers produce for the food industry, and an oil-free environment is one of their main requirements. In addition, there is a shortage of skilled workers. So the operation of the machines must become easier and easier, and the downtime has to be further reduced. That counts even more than the energy savings.

What is the availability of the PACE-E closure system? At 97 - 98 %?

Nomblot: We expect 98%. It is essential to focus on performance, quality and energy consumption requirements: If a toggle component, a spindle or a motor fails and causes maybe a week of production downtime, then you have already wasted the energy savings.

To get from 98 to 98.5 % requires enormous efforts. What is the issue here? Is it mainly mechanical engineering issues, control technology or IT? Or is it process engineering challenges?

Nomblot: Achieving the last percentage points is essentially a matter of preventive maintenance. It’s like Formula 1: you need the perfect team. Yes, and companies tend to lose team awareness. Some companies have super teams and everything runs smoothly.

But the same machine with the same tool in a different factory may have completely different results. Recently, one of our customers in Germany reported that ten years ago they had people who did nothing but grease the machine. And they knew exactly how to lubricate a machine, they knew the machine through and through. Today the situation is entirely different. Customers naturally expect centralised lubrication and that modern machines run with a minimum of staff and maintenance. Nevertheless: without a certain understanding of the machine and the technology, it doesn’t work.

_______________

''We expect 98%. It is essential to focus on performance, quality and energy consumption requirements: If a toggle component, a spindle or a motor fails and causes maybe a week of production downtime, then you have already wasted the energy savings.'' - Arnaud Nomblot

_______________

Digitalisation, Big Data

How helpful are digitalisation and Big Data for machine maintenance and operation? Are you working with AI to get 1% more availability?

Nomblot: With myConnect, we have an excellent product that customers can use to network their machines. It also helps the customer to look better after his machinery and to keep the documentation up to date, because everything is available digitally and online. We, as a supplier, can also access the machine remotely, manage troubleshooting for maintenance and provide application support before sending the service.

Are customers today more willing to give suppliers online access to their machines?

Nomblot: Yes, acceptance is better than it used to be. This is undoubtedly due to the situation during the pandemic, when services had to be provided remotely because of travel restrictions. Today, however, we also have to consider that the security regulations for IT systems are becoming stricter and stricter. So the brakes are often not put on by the operators, but by the IT departments.

On a technological level, wouldn’t it be extremely helpful to use data collected online to create the learning machine that uses digital technology to reduce failures and increase availabilities?

Liebig: That is absolutely correct. The masses of myConnect data are perfect for generating knowledge that can be used to optimize production and further develop our machines: We have real-time data and know what is being produced under what conditions. This opens up a wide range of possibilities that benefit the innovative development of our machines. We have therefore decided to offer the myConnect system free of charge. So far, only around 25-30% of all machines delivered work with myConnect. That is too little! Our goal: 70% of customers should actively use this technology.

_______________

''We have decided to offer the myConnect system free of charge.'' - Gerd Liebig

_______________

The following example clarifies the advantages: one of our customers in Mexico was strictly against myConnect. When a problem suddenly arose and no one could travel, we were still able to react: after the customer’s approval, we activated the myConnect box, an integral part of the system, and were able to solve the problem quickly. This customer did not have the system switched off again. - Yes, this is a constant learning process. In terms of positioning, Sumitomo Demag is very OEM-oriented in terms of its positioning. We have a lot of industry-oriented specialists, larger companies, and they are critical of the topic. But the realisation that myConnect provides fast support, reduces travel costs and builds up the operator’s competence is gaining ground.

What additional support do you offer?

Liebig: We also have a Smart Glass solution in our portfolio. The operator wears the glasses and guides us virtually through the system. That way we can instruct him. In future, the smart glass will also be included in the delivery package. And no one will want to do without it any more. In the packaging sector, about 80 % of machine downtimes are process-related. The smart glass solution provides very uncomplicated and costefficient support. Simply smart!

Nomblot: Data usage was a big plus in the development of the PAC-E. We used to work in a more machine-oriented way, with little production and process information. That’s what we changed for the development of the PAC-E: We analysed hundreds of application process data, talked to mould makers about processes and mould data and ultimately adapted the machine precisely for these requirements.

System idea

That’s what’s behind the system idea: machine plus tool plus peripheral equipment plus measuring and inspection technology. Everything must fit together optimally in order to ultimately establish a system in the high-end sector

Liebig: This important point has complex implications for us. This is because we are a German-Japanese company, and the systems approach does not exist in Japan. There’s the machine - that’s it. And of course there is always a kind of positive partnership rivalry between us when we discuss it. In the packaging sector, we solved this three years ago. When I started here, we benefited greatly from our Japanese colleagues in the first four years. Now things are starting to turn because we are able to source, advise and finally install machines for customers for the perfectly fitting solutions in the high-end, premium and high-performance sectors.

That’s where the industry-organised sales structure helps you, with the focus on the product rather than the region. What interests me regarding with the system approach is the inspection equipment of the various suppliers. They all supply the competition as well. How openly do you talk about technical details, for example to increase availability?

Nomblot: We talk quite openly. It is essential that the interfaces between our products are known on both sides and that the employees in application technology and installation, assembly and commissioning know the products. Yes, and the employees of the system partners must know each other well. If people don’t know each other, then it is often said that commissioning doesn’t run smoothly. But often it is only due to poor coordination.

Wynands: We choose our partners consciously. We value good, long-term relationships. This helps us internally and also sends a message towards our clients: We often work together, we can rely on each other. The contacts are clearly regulated: in the project planning area, in the service area. If problems arise, we can solve them quickly together in the interest of the customer.

Location, staff, needs, quality

You here in Germany are a strong link within the Sumitomo Group. How do you see the future?

Liebig: Our production here in Schwaig is up and running. That also prevents me from re-designing the factory - which I would be happy to do! Apart from the building and the site, we naturally have a big plus here: one of our advantages is the soft factors in the partner business.

There is no other company in the field of injection moulding machinery that is as international as we are. I am very proud of our diversity here in Schwaig. But I am worried about production in Germany. In order to be as flexible as possible, we have set ourselves up here on three pillars: In a crisis, we will not lay off staff. We recruit top-level staff. And our solidarity pact: if short-time work, then also with wage cuts in management. All this does not come for free, but we’ll be in the starting blocks when the market picks up.

Nevertheless, skilled personnel is undoubtedly an issue at the Schwaig site, isn’t it?

Liebig: Yes, like everywhere. The outlook for 10 or 15 years from now is a big issue. What are we going to do if we don’t have enough qualified staff then? We also want to grow here at the location.

The external conditions are perfect: we have increased our market share and doubled our all-electric machine sales in five years. We still have our plant in Thuringia, and I’ll tell you frankly: One consideration is to expand the plant in Thuringia more. Technology companies are better supported there than here in Bavaria. But we also have to be attractive as an employer here. We will open up working time flexibility and significantly reduce temporary work. You’re the first I tell this to. In my view, temporary work is no longer up-to-date. The important thing is to build up competence - right from the start. That starts with our training workshop. We invested in the entire machine park three years ago - everything is state-of-the-art now. And yes, we are lucky and get excellent apprentices, even though it is becoming increasingly difficult. Our benchmark is the number of staff interviews we need for an apprentice, which becomes more critical every year.

In the context of the current crises, we often come across the terms supply chains and deglobalisation. What is your position on these issues?

Liebig: During the pandemic, we managed the availability of materials very well and also learned from it. We had weaknesses in our sourcing concept. Container costs exploded last summer; currently they have fallen sharply. But we already realised at the end of 2020 that we had to change our sourcing concept. There are three reasons for this: availability of the material from Asia; the China policy, which was and is unpredictable due to lockdown decisions - we must not forget that about half of our 7000 machines a year go to China; we are one of the big suppliers in China. And the third reason is the drive for sustainability.

What does sustainability mean for your company at your production sites in Germany?

Liebig: The new machine puts us in a great position to meet the increased market demands. And sustainability in production is now also on our agenda; for example, we are equipping our plants with photovoltaics. We have always been energy consumption-oriented and have our KPIs (key performance indicators) for waste here in the company. My assessment: Sustainability in the production process will continue to be a massive challenge and keep us busy in the coming years - that is good and important! Third aspect: We are also in a great position with regard to our customers: We have our plants everywhere and produce close to the customer.

Competitive environment

Let’s come back to technology. What are the key criteria of the PACE-E?

Wynands: First, an internal look at the different machine generations we showed at the K trade fairs in 2019 and 2022. Both machines ran the same application with the same tool. In 2019 it was the El-Exis SP, in 2022 the all-electric PAC-E. The energy consumption has halved, with the same basic conditions. That is huge.

Nomblot: If we compare this with the competition, we already know that we have an enormous energy consumption advantage: It is in the double-digit range. Up to now, the El-Exis has also been the benchmark in terms of energy consumption for the top machines of this cycle time. And with the PAC-E we have halved the energy consumption again.

Thank you very much for the warm welcome here in Schwaig and the open conversation.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2025.