Key Business Progress in 2022:

- For Avantium Renewable Polymers, 2022 was a breakthrough year:

- The conditions for Financial Close were achieved, including a €90 million Debt Facilities Agreement, which allowed Avantium to begin construction of the FDCA (furandicarboxylic acid) Flagship Plant;

- Construction of the FDCA Flagship Plant in Delfzijl is progressing well, with commercial production set to start in 2024;

- Eight new offtake agreements for FDCA and PEF (polyethylene furanoate) were secured in 2022 and early 2023 with well-known brand owners and industry leaders including Carlsberg, LVMH, AmBev and Henkel. In addition, Avantium announced this morning that it has signed an offtake agreements with Kvadrat. In total 14 offtake agreements for a wide range of applications have been signed;

- The first industrial technology license agreement for YXY® Technology was signed with the US-based company Origin Materials ahead of original expectations;

- In Avantium Renewable Chemistries, operations of Ray Technology™ are back on track after a temporary pause in 2021 and preparations to scale-up to a commercial facility for plantMEG™ (mono-ethylene glycol) and plantMPG™ (mono-propylene glycol) have begun;

- For Volta Technology, two demonstration units have been successfully trialled at industrial sites in Germany and Greece;

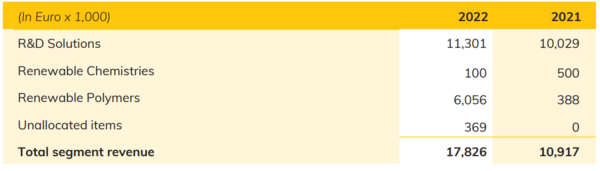

- Avantium R&D Solutions (formerly known as Avantium Catalysis) has adopted a new growth strategy focusing on R&D solutions for sustainable chemistry, in addition to its existing offering; total revenues for Avantium R&D Solutions improved by 13%, compared with 2021, to €11.3 million.

Key Financial Developments in 2022:

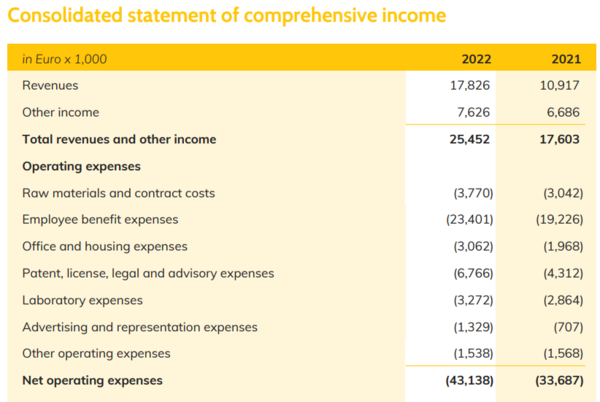

- Total revenues increased by 63% to €17.8 million (FY 2021: €10.9 million), predominantly due to the payment of €5.0 million received from Origin Materials in 2022 as part of the transaction announced in February 2023. Other Income from government grants increased by 14% to €7.6 million (FY 2021: €6.7 million), primarily related to the start of the construction of the FDCA Flagship Plant;

- Net operating expenses were €43.1 million in 2022 (FY 2021: €33.7 million), increasing primarily due to the planned increase in FTE during 2022, costs associated with new patent filings, and legal and advisory expenses related to Financial Close, the Equity Raise, and the Debt Facilities Agreement entered into for the financing of the FDCA Flagship Plant;

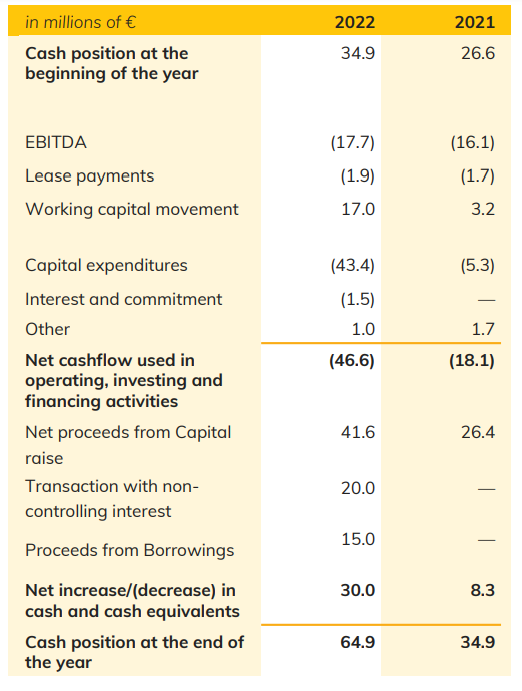

- Cash at 31 December 2022 was €64.9 million (31 December 2021: €34.9 million):

- The increase in the cash position was due to the successful capital raise of €41.6 million (net proceeds) by means of a public offering of shares in Avantium N.V. in April 2022, a €20.0 million cash investment in Avantium Renewable Polymers B.V. from Bio Plastics Investment Groningen in March 2022, and the first drawdown of €15.0 million under the Debt Facilities Agreement in November 2022;

- Net cash outflow1 in 2022 was €46.6 million (FY 2021: €18.1 million), primarily related to planned investments in the engineering and construction of the FDCA Flagship Plant;

- The loss for the period was €31.6 million (2021: €24.4 million).

Tom van Aken, Chief Executive Officer of Avantium, commented: “I am very proud of what Avantium has accomplished in 2022, a transformational year for the company - evolving from a company primarily focused on R&D towards one with large-scale manufacturing and commercialisation capabilities. The start of the construction of our FDCA Flagship Plant was a significant milestone, and will enable the commercial launch of our plant-based, recyclable and high-performance polymer PEF to customers worldwide. We continue to see robust demand for FDCA and PEF as illustrated by us signing nine new FDCA and PEF offtake agreements with major brand owners for a range of applications. The FDCA Flagship Plant is a key component of our YXY® licensing strategy and the progress in constructing this facility was an important catalyst in establishing the recently announced transactions with Origin Materials to accelerate the mass production of FDCA and PEF. We have now clearly demonstrated the exciting potential to license our proprietary technologies and continue to make encouraging progress in this regard."

Business Overview

Avantium Renewable Polymers

For Avantium Renewable Polymers, home to the YXY® Technology, 2022 was the breakthrough year. Having confirmed our positive Final Investment Decision for the world's first FDCA Flagship Plant in December 2021, and having received the support of Avantium’s shareholders at an Extraordinary General Meeting in January 2022, we achieved the conditions for Financial Close on 31 March 2022, paving the way for construction to begin.

Upon Financial Close, our engineering partner Worley and investment partner Bio Plastics Investment Groningen (formerly the Groningen Consortium) became minority shareholders in Avantium Renewable Polymers B.V.. They now own a combined share of 22.6% in the entity, while Avantium N.V. retains 77.4% of the equity. Avantium Renewable Polymers received a €20 million cash investment from Bio Plastics Investment Groningen at Financial Close. Worley’s €10 million equity investment in Avantium Renewable Polymers is structured as (i) an investment in kind and (ii) a 50%–50% risk-sharing mechanism over the engineering, procurement and construction (EPC) phase of the FDCA Flagship Plant.

At Financial Close, Avantium also entered into a €90 million Debt Facilities Agreement with a consortium of Dutch banks, comprising ABN AMRO Bank, ASN Bank, ING Bank and Rabobank, as well as with the Dutch government-backed impact investment fund Invest-NL. Each bank has committed €15 million, and Invest-NL has committed €30 million under the Debt Facilities Agreement. In November 2022, the first drawdown of €15 million under the Debt Facilities Agreement took place.

The construction of the FDCA Flagship Plant is progressing well. By the end of 2022, more than 700 piles had been driven into the ground and the civil works had been completed, including installing the foundations, floors, piping, roads and walls. In addition, a significant portion of the steel construction and storage tanks have already been erected. After a thorough review of the project execution plans and the expected delivery and installation of equipment, mechanical completion of the FDCA Flagship Plant is now expected in the first quarter of 2024.

Avantium secured nine new offtake agreements for FDCA and PEF in 2022 and 2023, taking the total to 14. Our new customers include LVMH Group (cosmetics packaging), Sukano (masterbatches), Carlsberg (drinks packaging), AmBev (soft-drink bottles), Monosuisse (industrial yarns), Henkel (adhesives), Origin Materials (sustainable chemicals and materials), Kvadrat (interior textiles) and an undisclosed brand owner. Prior to 2022, Toyobo (films), Terphane (food packaging), Refresco (drinks packaging) and Resilux (packaging) were among those who had already signed offtake agreements.

Over the summer, Carlsberg tested 8,000 of its PEF-lined Fibre Bottles in a real-world setting, putting PEF in the hands of consumers for the very first time. Avantium also launched a new PEF Textile Community in June 2022, together with Antex (a producer of yarns made from PEF) and four other partners who will use Antex’s yarn to develop PEF fabric applications in different market segments, including industrial fibres, sportswear and fashion clothing. We aim to collaborate with and learn from one another to further develop the application of PEF in the textile industry.

In February 2023, Avantium entered into its first industrial technology license agreement with Origin Materials, having already received a non-refundable payment of €5 million for technical due diligence performed by Origin Materials in 2022. More information on this transaction can be found under 'Events occuring after 31 December 2022' on page 11 of this press release.

Avantium Renewable Chemistries

Avantium Renewable Chemistries develops and commercialises innovative chemistry technologies based on viable, non-fossil sources of carbon. The business unit is home to three technologies: Ray Technology™, Dawn Technology™ and Volta Technology.

In the first half of 2022, Avantium restarted the Ray demonstration plant as operations had been temporarily paused. The plant operated successfully throughout the rest of the year, generating important data to inform the engineering plans for the proposed Ray Technology™ Flagship Plant. This industrial-scale plant is planned to be constructed as part of a joint venture with the sugar manufacturer (and feedstock supplier) Cosun Beet Company. Discussions are underway with interested partners to prepare for commercial validation and to potentially establish offtake agreements for this Ray Technology™ Flagship Plant. Cosun Beet Company and Avantium are still in the process of selecting the optimal site in Northwest Europe for the construction and operations of the commercial facility. Meanwhile, Avantium has also initiated activities to explore additional partnerships using other feedstock sources and targeting markets outside of Europe.

In 2022, Avantium continued optimising its Dawn Technology™, a promising solution for de-fossilising the chemical industry through the conversion of agricultural and forestry residues to high-value chemicals and materials. Further progress was made on new feedstock testing during the year, in particular with cotton/ polyester blends in waste textiles, which make up the highest volume of non-recyclable waste textiles. Avantium’s Dawn Technology™ converts cotton (cellulose) into glucose, liberating the polyester for recycling.

2022 was an exciting year for Volta Technology, Avantium's carbon capture and utilisation (CCU) solution focusing on the conversion of CO2 to formic acid, oxalic acid and glycolic acid. In January 2022, Avantium installed a mobile Volta Technology container unit at a power plant in Germany. This mobile unit – containing the largest cell of this type of technology anywhere in the world – operated successfully until the close-out in October 2022, converting CO2 into formate at a rate of 250–500 g/hour for more than 1,000 hours. A second CCU unit was deployed at a Titan cement plant in Greece, using waste CO2 to make formic acid that can then be added into the cement to improve its quality. The success of this unit is particularly encouraging as it produces formic acid in a more cost-efficient way, hosting two chemical reactions in a single cell. In May 2022, Avantium was awarded a €3 million grant by the EU Horizon Europe programme as part of its involvement in the WaterProof consortium2 . Under this four-year programme, which aims to demonstrate the full value chain of a closed carbon cycle, Avantium's Volta Technology is being used to convert CO2 from wastewater purification and waste incineration into formic acid. This formic acid can then be used to make new consumer products.

Avantium R&D Solutions

In 2022, the Avantium Catalysis business unit launched a new strategy and a new name – Avantium R&D Solutions – marking a strategic shift towards R&D in sustainable chemistry. As well as continuing to provide advanced catalysis systems and services to customers around the world, Avantium R&D Solutions has expanded its business focus into four sustainable chemistry markets: i) green hydrogen via water electrolysis, ii) chemical plastic recycling via pyrolysis, iii) adsorption and iv) sustainable chemical building blocks. At the end of 2022, Avantium R&D Solutions had already secured the first commercial contracts for custom-made units for adsorption and chemical conversion, and expects to gain more contracts in 2023.

Meanwhile, Avantium R&D Solutions' existing business including the Flowrence® technology (proprietary catalyst testing) and Batchington unit (small-scale, multiple-parallel batch testing), together with R&D Services, continues to develop. In 2022, revenues generated by Avantium R&D Solutions grew 13% to €11.3 million (FY 2021: €10.0 million).

Patents

Avantium has 156 patent families containing more than 900 patent rights. Last year, 24 new patents were granted to Avantium, for YXY® Technology (16), Ray Technology™ (3), Dawn Technology™ (4) and our early-stage technologies developed by our Corporate Technology team (1). This very active patenting strategy not only helps safeguard Avantium’s leading position as a technology development company and a frontrunner in renewable chemistry, but also plays a pivotal role in our licensing strategy.

Equity Raise 2022

On 14 April 2022, Avantium successfully raised €45 million (gross proceeds) by means of a public equity offering with a priority allocation for its existing shareholders, a retail offering and a private placement. The company issued 11,250,000 new shares, which represented c. 36% of the issued share capital. Pricing of the capital increase was fixed at €4.00 per share, a 20% discount versus the previous closing price.

Organisation

Management Board Composition

In an Extraordinary General Meeting on 30 November 2022, Avantium's shareholders confirmed the appointment of Boudewijn van Schaïk to the position of Chief Financial Officer and member of the Management Board, effective 1 January 2023 and until the Annual General Meeting in 2027.

Supervisory Board Composition

Cynthia Arnold and Trudy Schoolenberg resigned from the Supervisory Board for personal reasons in March 2022 and August 2022, respectively. At the end of 2022, the Supervisory Board comprises Edwin Moses (chair), Margret Kleinsman, Michelle Jou and Nils Björkman. In early 2023, Avantium nominated Dirk Van Meirvenne and Peter Williams for the Supervisory Board, bringing the percentage of women in the Supervisory Board to 33%. The Supervisory Board will propose their appointments to the Annual General Meeting on 10 May 2023.

People

To support the further development of Avantium and to access the new skill sets necessary as we move towards large-scale manufacturing and licensing, the Avantium workforce increased by 16.30% over 2021, to a total of 264 people at the end of the year.

Financial results

The Avantium 2022 financial statements have been prepared on a going concern basis.

Income Statement

In 2022, Avantium’s consolidated revenues increased by 63% to €17.8 million (FY 2021: €10.9 million).

In 2022, income from government grants increased by 14% to €7.6 million (FY 2021: €6.7 million). The higher grant income recognition was predominantly in Avantium Renewable Polymers coming from previously awarded grant programmes (PEFerence3 , IMPRESS4 , and DEI+5 ) and is related to the progress made in connection with the start of the construction of the FDCA Flagship Plant. Avantium successfully secured an additional grant in 2022, to support its participation in the four-year R&D programme WaterProof6 .

Net operating expenses amounted to €43.1 million in 2022 (FY 2021: €33.7 million). This increase is mainly the result of the planned increase in staffing during 2022. In addition, patent, license, legal and advisory costs increased as a result of the professional and advisory services received in relation to the Equity Raise, Financial Close, and the Debt Facilities Agreement.

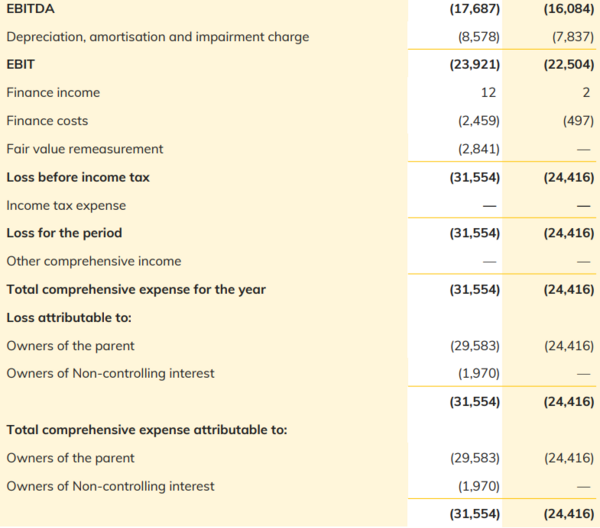

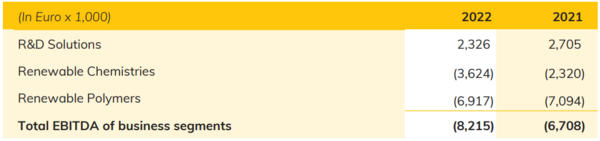

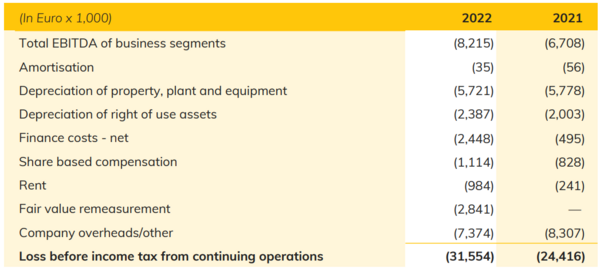

Total EBITDA decreased in 2022 to €-17.7 million (FY 2021: €-16.1 million). In Avantium R&D Solutions, there was a decrease in EBITDA for 2022 as a result of higher costs in raw materials and contract costs as well as higher employee benefit expenses due to a planned increase in FTE throughout the year. In Avantium Renewable Chemistries, the EBITDA decreased due to lower income from government grants and lower revenues. Avantium Renewable Polymers showed an improved EBITDA in 2022 as a result of higher revenues, which were partly offset by an increase in costs. The higher costs were predominantly related to expenditures incurred for the partial divestment in Avantium Renewable Polymers in March 2022 and higher legal and advisory services in relation to Financial Close, the Equity Raise, and the Debt Facilities Agreement, as well as an increase in costs related to support activities contracted from Avantium, including HR, Finance and Legal services.

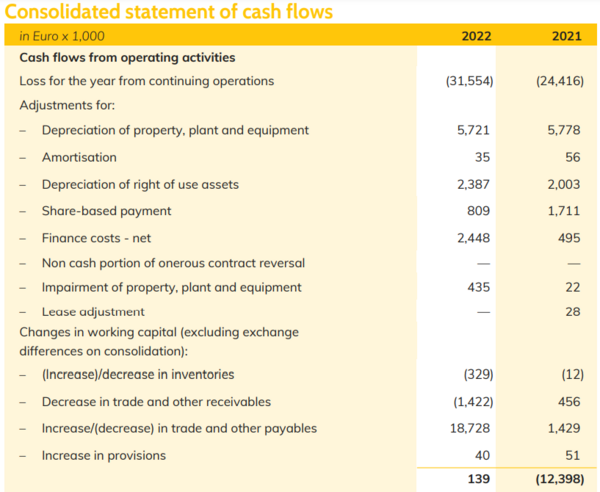

Avantium’s net loss for 2022 increased to €31.6 million (FY 2021: €24.4 million) due to the lower EBITDA and higher depreciation and finance costs.

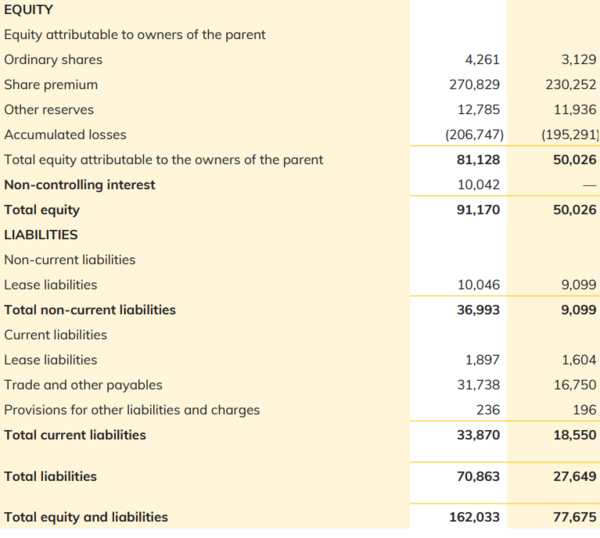

Balance Sheet and Financial Position

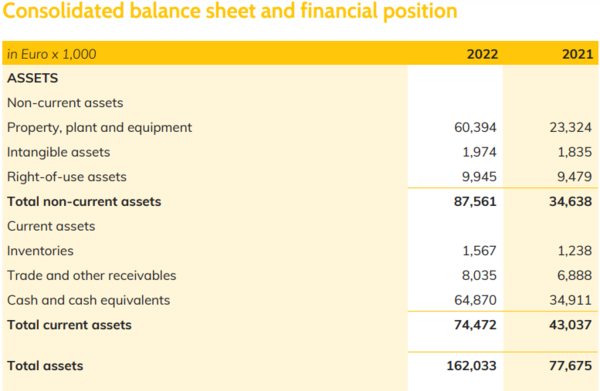

The balance sheet total assets increased to €162.0 million (2021: €77.7 million). Total net equity increased to €91.2 million (2021: €50.0 million).

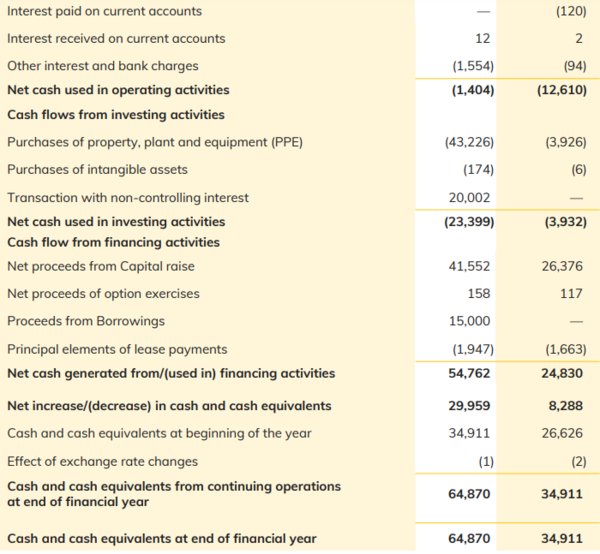

Avantium’s cash position (including restricted cash) was €64.9 million at 31 December 2022 (31 December 2021: €34.9 million). During 2022, Avantium's cash position improved substantially as a result of a number of extraordinary transactions that took place during the year. Firstly, the successful capital raise by means of a public offering of shares in Avantium N.V. that took place in April 2022, which generated net proceeds of €41.6 million. In addition, Avantium Renewable Polymers received a €20.0 million cash investment from Bio Plastics Investment Groningen for the shareholding it acquired in Avantium Renewable Polymers. Furthermore, in November 2022, the first drawdown of €15.0 million under the Debt Facilities Agreement for the FDCA Flagship Plant took place.

Avantium’s cash outflow increased by €28.5 million (excluding extraordinary cash inflows related to equity and debt) to €46.6 million in 2022 (FY 2021: €18.1 million) The cash outflow in 2022 mainly related to a €38.1 million increase of planned investments in capital expenditure for the engineering and construction of the FDCA Flagship Plant.